Buyers and sellers in the Toronto area are starting to come out in May after lockdown measures surrounding the coronavirus brought sales to a halt in the last half of March and through April. While the economy continued to be impacted by the COVID-19 pandemic in May, activity in the housing market continued albeit at a much different pace than last year.

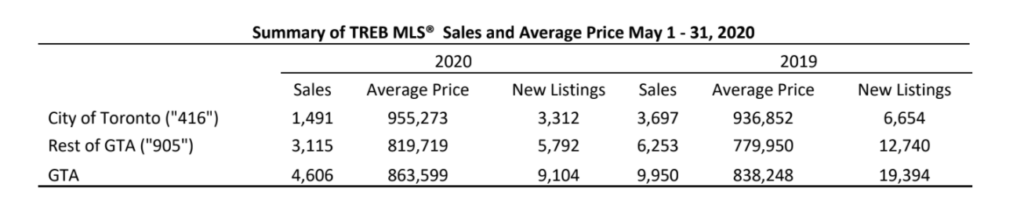

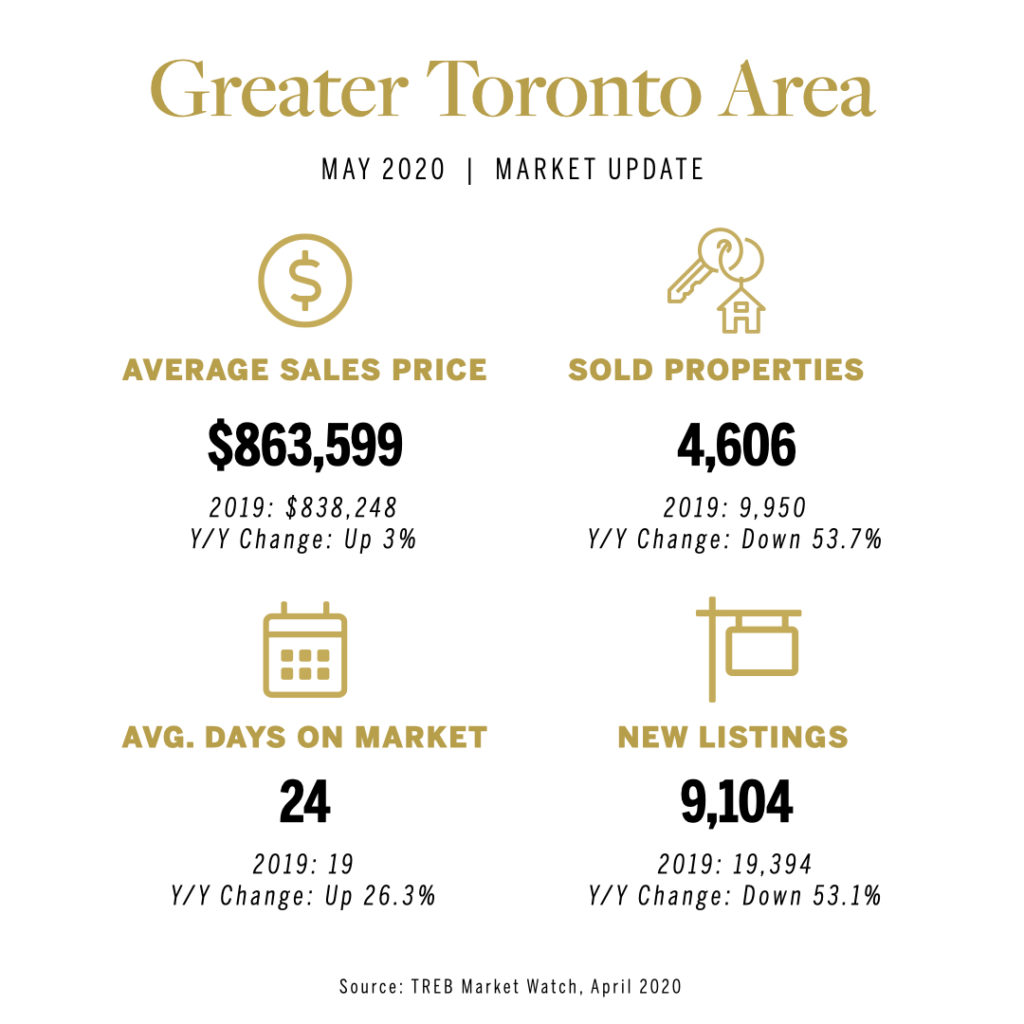

The Toronto Regional Real Estate Board (TRREB) reported there were 4,606 home sales in the Greater Toronto Area (GTA) in May 2020. This is a decline in sales by 53.7 per cent compared to May 2019. While the number of sales was down substantially on a year-over-year basis due to the continued impact of COVID-19, the decline was less than the drastic 67.1 per cent year-over-year decline reported for April 2020. On a month-over-month basis, actual and seasonally adjusted May sales were up substantially compared to April. Actual May 2020 sales increased by 55.2 per cent compared to April 2020. After accounting for the regular seasonal increase that is experienced each year between April and May, seasonally adjusted sales were up by 53.2 per cent month-over-month.

The number of new residential listings in May was down by a similar annual rate to that of sales, dipping by 53.1 per cent to 9,104 listings. On a month-over-month basis, actual new listings were up by 47.5 per cent from April. Although the public health and economic concerns surrounding COVID-19 continue to impact the housing market, May sales results represented a marked improvement over April. In other words, while May was by no means a banner month for Toronto area real estate, it was better in nearly every way than April, suggesting that the market may be starting to look past COVID-19 and all its implications.

While sales and new listings were down in May, the average selling price of all home types combined increased slightly by three per cent year-over-year to $863,599 and the average selling price was up 4.6 per cent month over month compared to April 2020. The benchmark price for new listings which is considered the price of a typical home in a given area was virtually unchanged from April, however on a year-over-year basis it rose 9.4 per cent.

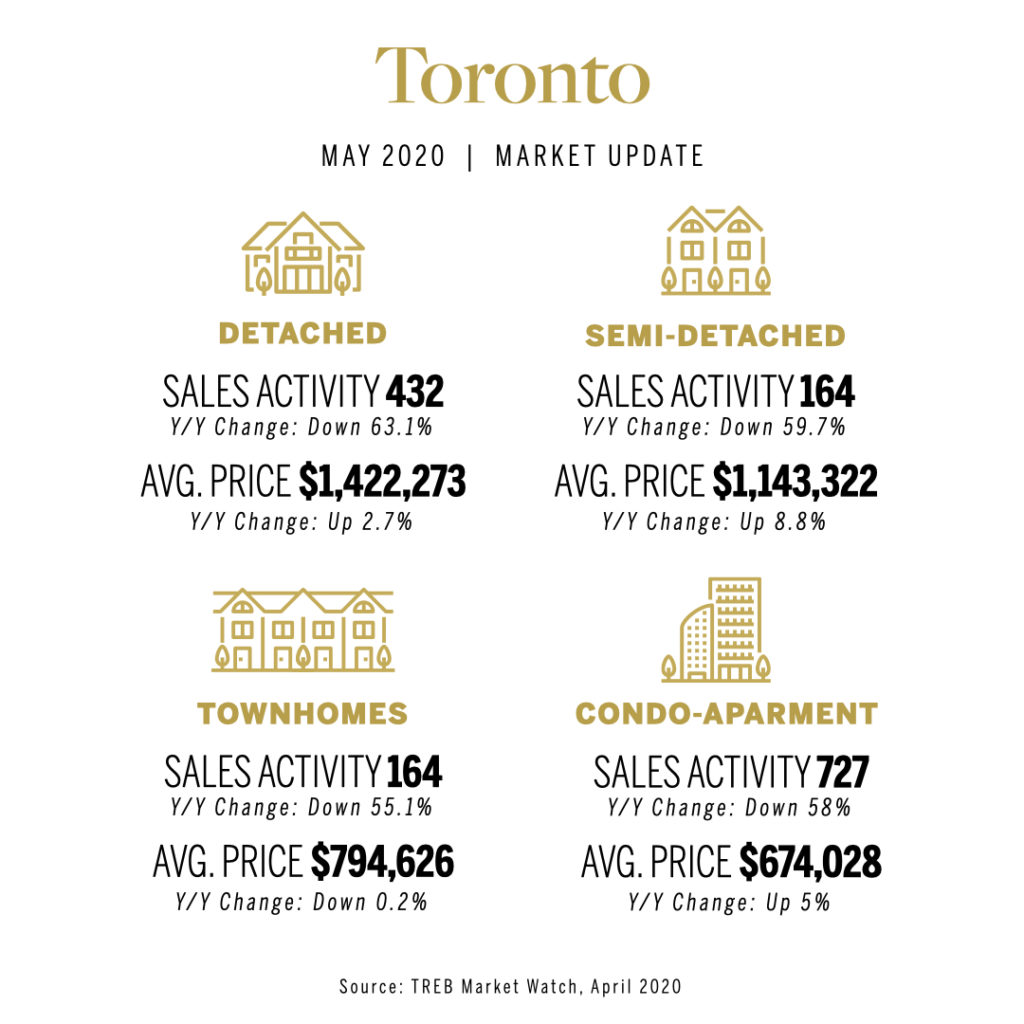

The difference in year-over-year growth and the average selling price could be related to the decline in detached-home sales in the City of Toronto, which were down by a greater annual rate than overall sales in the GTA.

“With home sales and new listings continuing to trend in unison in May, market conditions remained balanced. This balance was evidenced by year-over-year average price growth slightly above the Bank of Canada’s long-term target for inflation,” said Jason Mercer, TRREB’s Chief Market Analyst. It is anticipated, if current market conditions are sustained during the gradual re- opening of the GTA economy, a moderate pace of year-over-year price growth could continue as we move through the spring and summer months.

When looking at the prices within the different segments of the market, the average price of a detached home in the City of Toronto increased 2.7 per cent to $1.42 million in May, compared to the region-wide average that fell 0.9 per cent to $1.03 million. Condos also continued to see price gains, with the average price increasing 6 per cent across the region to $625,445, while condo prices in the City of Toronto on average rose 5 per cent to $674,028.

TRREB released updated Ipsos consumer intentions polling results in May that indicated that 27 per cent of GTA households were likely to purchase a home over the next year. Assuming we continue to see a gradual re-opening of the economy, home sales possibly will continue to improve in the coming months. The housing sector will be a key growth driver of the economy as consumer confidence increases and more households look to take advantage of very low borrowing costs during the recovery process. It will be important for policy makers at all levels of government to continue to bring a greater diversity of ownership and rental housing supply. This will help ease the pace of home price growth accelerating to unsustainable levels.

As for the condominium rental market, one-bedroom and two-bedroom condominium apartment rental transactions were lower in May 2020 compared to May 2019. The number of one-bedroom rentals was down by 30.8 per cent to 1,290. The number of two-bedroom rentals was down by 26.7 per cent to 820. However, like home sales there was a marked improvement in rental transactions between April 2020 and May 2020. The number of one-bedroom rentals, at 1,290, was well-above the 754 mark for April. Similarly, the number of two-bedroom rentals, at 820, was well-above the 489 rentals reported for April.

On a year-over-year basis, average condominium apartment rents continued to be lower than last year’s levels in April. The average one-bedroom rent was $2,086 in May 2020, down by 5.1 per cent compared to May 2019. The average two-bedroom rent was $2,740 in May 2020, down by 5.6 per cent compared to May 2019.

May results show the demand for Toronto real estate still very much exists. It appears both homeowners and buyers are becoming more comfortable with in person home tours as more restrictions are lifted. All in person home showings these days abide by strict COVID preventing measures. Data shows in person home showings were up 95 per cent for the month of May over April.

I would expect more and more sellers will be confident putting their homes on the market in the coming days as they realize there appears to be a real pent up demand. Many properties over the past couple of weeks have been getting multiple offers within a few days of being listed as the supply has been so tight. We will see as we move through June if May was an anomaly, or the beginning of a return to some sort of normalcy of the Toronto market.