A true market rebound is likely still a little way off, but signs of life were detected in the Greater Toronto Area (GTA) housing market this September, according to the Toronto Regional Real Estate Board’s (TRREB’s) latest report.

“As buyers take advantage of changes to mortgage lending guidelines and borrowing costs trend lower, home sales will steadily increase in relation to population growth. With every rate cut, a growing number of GTA households will afford a long-term investment in home ownership, including first-time buyers,” said Toronto Regional Real Estate Board (TRREB) President Jennifer Pearce.

The recent series of three rate cuts by the Bank of Canada seems to have breathed new life into the GTA resale market. According to TRREB, September saw 4,996 properties sold—an improvement over the last few months and an 8.5% increase from the 4,606 sales reported in September 2023. While the numbers suggest a positive trend, they don’t tell the complete story. September is a key month for the fall market—historically there about 7,500 transactions. In fact, pre-pandemic in 2019 there were 7,795 homes sold. So, this September’s figure is still quite low, even falling behind the sales numbers from over 20 years ago when the population was significantly smaller. For instance, in September 1998, 5,429 properties sold and the following year there were 5,897 sales.

A simple year-over-year comparison doesn’t capture the full scope of what’s happening in the Toronto market. Freehold properties—especially detached and semi-detached homes—have generally held their value, despite increasing inventory. New listings totalled 18,089 in September, up by 10.5% year over year.

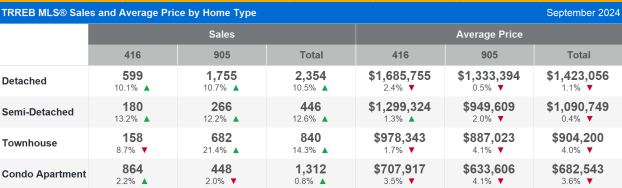

Of the sales recorded, 2,354 were detached homes, up 10.5% year over year, 446 were semi-detached, up 12.6%, and 682 were townhomes, up 14.3%. The only residence type to that remained flat in sales were condos, which saw 1,312 sales, just a 0.8% increase.

In the City of Toronto (the 416 area), detached homes sold for an average of $1,685,755, while semi-detached homes averaged $1.3 million. In the surrounding 905 area, prices were a bit lower, with detached homes selling for $1,333,394 and semi-detached homes for $949,609. These values are only slightly off from last year’s figures.

On that note, the MLS® Home Price Index Composite benchmark dipped by 4.6% compared to last September, with the average selling price sitting at $1,107,291. This is down by only 1% compared to September 2023’s average of $1,118,215. In August the price sat at $1,074,425, which on a seasonally adjusted basis, actually represents a slight month-over-month increase for September.

“The annual improvement in September home sales was more than matched by the increase in new listings over the same period. This resulted in a better-supplied market and increased negotiating power for buyers re-entering the market. The ability to negotiate on price, led to moderate year-over-year price declines, particularly in the more affordable condo apartment and townhouse segments, which are popular with first-time buyers,” said TRREB Chief Market Analyst Jason Mercer.

What’s more, homes in the City of Toronto sold quickly—detached properties fetched 100% of their asking price on average within 21 days, while semi-detached homes sold for 104% of the asking price in just 17 days. Some neighborhoods even saw faster sales with higher percentages over asking. These figures signal a resilient market, at least for ground-level housing.

The condominium market on the other hand, is a different story. Condos are struggling to keep up. By the end of September, there were nearly 9,000 condos on the market, making up 35% of all available listings. However, only 1,312 condos sold that month—less than 27% of all reported sales. This discrepancy highlights a growing inventory imbalance.

The reasons behind the condo market’s weakness are rooted in history. Over the past decade, and especially during the pandemic, rising costs—often driven by government policies—led developers to build smaller and smaller units. The average size of a new condo has shrunk by 35%, from about 1,100 square feet to just 700 square feet. Many of these smaller units were sold to investors, including foreign investors. Now, despite higher rental prices, increased financing costs and a dip in condo prices are pushing investors to sell, flooding the market with “matchbox” units. Adding to the challenge, new legislation restricting foreign ownership has removed a significant portion of potential buyers. It’s unlikely that this segment of the market will correct itself anytime soon.

September also brought some noteworthy changes at the federal level. Starting December 15, all first-time buyers will be eligible for 30-year amortizations on insured mortgages, which will allow buyers to enter the market with smaller down payments. Additionally, the cap on insured mortgages will rise from $1 million to $1.5 million, making it easier for buyers to access financing in markets like Toronto, where average sale prices often exceed $1 million.

These mortgage changes coupled with the recent rate cuts, are expected to bring more momentum into the market. The Bank of Canada still has two more rate announcements scheduled before the end of the year, with economists predicting further cuts of possibly 0.50% in October and similar in December. By mid-2025, the overnight rate could drop as low as 2.75%.

Looking forward, these combined factors—lower borrowing costs and new federal mortgage measures—are poised to wake the market from its two-year lull.