The main takeaways for the month of October from the Toronto Regional Real Estate Board (TRREB) are the number of homes sold in the Greater Toronto Area (GTA) continues to decline, prices seem to have flattened and new listings are down significantly. The decline in home sales is a continuation of a pattern that started in March when the Bank of Canada began its plan to arrest runaway inflation through higher lending rates.

The Bank further increased the benchmark rate by 0.5 % in late October and after six rate hikes since early March when the rate was 0.25%, the current rate sits at 3.75%.

The good news for prospective buyers on the sidelines, prices have remained steady for the past three months after declining in the spring. New listings are also down year-over-year and month-over-month. The persistent lack of inventory helps explain why the downward trend in home prices experienced in the spring has flattened over the past three months.

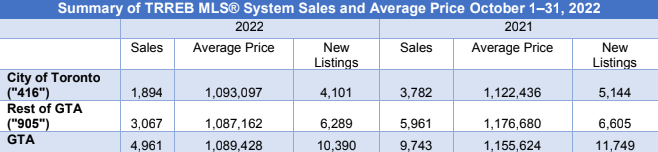

A total of 4,961 homes traded hands in October, down only 1.5% from the 5,038 that sold in September; however, this is down 49.1% year-over-year. The average days on market was 21 days.

The average selling price for all home types combined was $1,089,428, down 5.7% from October 2021 but up slightly from September’s average of $1,086,762. Although average sale prices are substantially lower than in February, over the last few months they have stabilized, and in fact, are slowly rising. Average sale prices hit a low of $1,074,052 in July. Since then, average sale prices have increased by almost 1.5 % to $1,089,426, despite further mortgage interest rate increases.

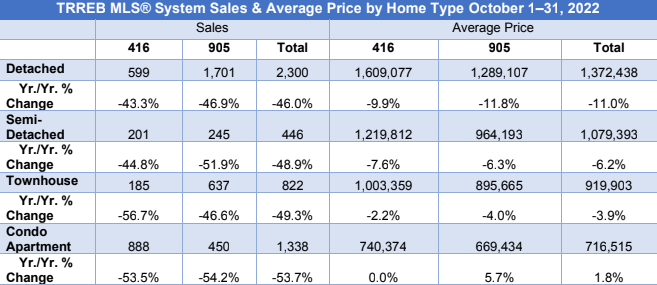

Condos are still the stand-out property type in the 416 area, with no change in average price month-over-month and up 1.8% year-over-year in the GTA.

When comparing figures to previous years, it’s important to remember the real estate trends we experienced through the pandemic were not “normal”. The year 2020 started off with historical lows but was breaking records by the fall, records that were then broken all over again in 2021 until we hit the peak in February 2022. However, after six rate hikes this year, and compared to the record-breaking year that 2021 was, prices in the detached segment are down 11% and semi-detached properties are down only 6.2%. Townhouses and condos are holding strong in Toronto and the surrounding GTA, with townhouse average prices dipping only 3.9% year-over-year, and as mentioned above, condos are still up. Comparing these prices to 2019, we are still up in all market segments. For example, the average price for a detached house in the City of Toronto in October 2019 was $1.323M and in October 2022 the average price was $1.609M, an increase of 22%.

The number of new listings continues to decline as sellers wait out shaky market conditions. Just 10,390 homes were brought to market, almost 12% fewer than the 11,749 listed last October, and the lowest level in October seen since 2010. This was felt more sharply within the city with only 4,101 brought to market, down 20% compared to the 6,289 listed in the 905 area. New listings were down on an annual basis more so for mid-density and high-density home types, which helps to explain why prices have held up better in these categories compared to detached houses.

“With new listings at or near historic lows, a moderate uptick in demand from current levels would result in a noticeable tightening in the resale housing market in short order. Obviously, there is still a lot of short-term economic uncertainty. In the medium-to-long-term, however, the demand for housing will rebound,” explains TRREB President Kevin Crigger.

With the threat of a recession rising, the central bank slowed the pace at its October meeting, delivering a 50- basis-point hike rather than the 75 basis points it did at the meeting before. This has prompted speculation that Canada’s central bank may be nearing the end of a rate cycle that has put such pressure on the economy, and the housing market.

We may have hit the bottom that so many prospective buyers and sellers have been waiting for. So, does that mean it’s all up from here? “Home prices in the GTA have found support in recent months,” Jason Mercer, the Toronto real estate board’s chief market analyst, said in a press release, referring to the Greater Toronto Area. “The Bank of Canada’s most recent messaging suggests that they are reaching the end of their tightening cycle.”

At the first sign mortgage interest rates have stabilized, and more importantly, when they reverse and start heading downward, it is anticipated the market will accelerate dramatically, returning to a pace reminiscent of pre-pandemic levels. Based on the Bank of Canada’s most recent pronouncement on the economy and inflation, that should happen by the second quarter of 2023. They also indicated that by the end of next year inflation should be reduced to 3% returning to 2% by 2024.

The sustained market slowdown will be felt in other areas of the economy beyond just real estate, says TRREB CEO John DiMichele.

“The housing sector has certainly been impacted by rising borrowing costs, and so too have other sectors of the economy with linkages back to housing,” he says. “Housing-related spin-off benefits to the GTA economy, which average $70,000 per transaction, will be down by close to $3B this year. Associated jobs and government revenue streams will suffer as well. This illustrates the balancing act the Bank of Canada will be dealing with in the months ahead. It will also be incumbent on policymakers to ensure that inflation is not being furthered by price gouging at the retail level.”

Also keep in mind, on November 1st, the Federal Government announced an updated immigration plan that includes a significant increase in the number of immigrants entering Canada between 2023 and 2025. The plan calls for 465,000 new permanent residents in 2023, 485,000 in 2024, and 500,000 in 2025. The highest levels in history, with close to half of them finding their way to Ontario. All these factors point to the resurgence of a very strong resale market in the GTA. Public policy initiatives like the recently introduced provincial More Homes Built Faster Act, designed to increase supply optimistically by 1.5 million homes to affordably meet the needs of new households over the next decade will help but demand will still be greater than supply.

As we wrap up 2022 over the next few weeks, we anticipate little change in sales volume or average sale prices other than the further seasonal slowdown around the holidays in December.