The Greater Toronto Area’s (GTA) robust real estate market further intensified last month as home sales topped a November record and average selling prices reached a new all-time high.

November’s reported sales brought the total year-to-date sales to 115,716 residential properties sold. With one month remaining in 2021, it is anticipated the year will finish with approximately 122,000 sales. This exceeds the previous annual record for properties sold in 2016 when 113,040 properties were sold.

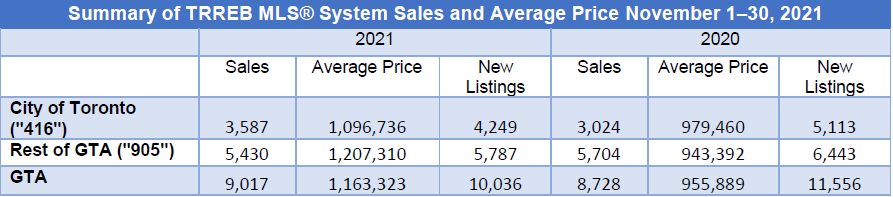

In November, the Toronto Regional Real Estate Board (TRREB) reported 9,017 homes were sold in all the GTA. This is a record number for any previous November and a 3.3 per cent increase over last November when 8,728 homes traded hands. There is still greater activity in the surrounding 905 area where 5430 homes were sold compared to 3587 homes in the City of Toronto. And of these 9,017 homes sold, 2868 or 32 per cent were condominium apartments.

Aside from the new records achieved, the news with the November data continues to demonstrate the trend of what’s happening to prices and the region’s disappearing inventory.

The supply problem became even worse in November. For the sixth continuous month, new listings dropped on a year-over-year basis down by 13.2 per cent to 10,036 in November from 11,445 in November 2020, with double-digit declines for low-rise home types and condominium apartments.

With 9,017 properties reported sold last month, almost the same number as new listings that came to market, we entered December with only 6,086 properties available to buyers. This is 56 per cent fewer listings available than the 13,798 listings at the same time last year.

It comes as no surprise that sales of all types of properties are happening at lightning speed with this dire lack of supply. In the City of Toronto, all detached properties were reported sold in just 13 days. Semi-detached properties sold in just 11 days. In the 905 region, all semi-detached properties that came to market in November sold in a mere 8 days. Another record for the month of November was the months of inventory. For the first time, months of inventory for the GTA dropped below one month to a level of 0.9 months.

“Governments at all levels must take coordinated action to increase supply in the immediate term to begin addressing the supply challenges of today, and to work towards satisfying growing demand in the future,” said TRREB President, Kevin Crigger.

“The GTA remains the primary destination for new immigrants and is at the centre of the Canadian economy. For far too long, governments have focused on short-term bandaid policies to artificially suppress demand. Current market activity highlights decisively that these policies do not work, and unless governments work together to cut red tape, streamline the approval processes, and incentivize mid-density housing, ongoing housing affordability challenges will escalate.”

Prices were simultaneously rising in November for the third straight month as the shortage of properties for sale stoked competition. We are seeing buyers desperate and scrambling to get in before the affordability worsens. The average selling price for all home types combined in the GTA was $1,163,323 – up by 21.7 per cent compared to November 2020.

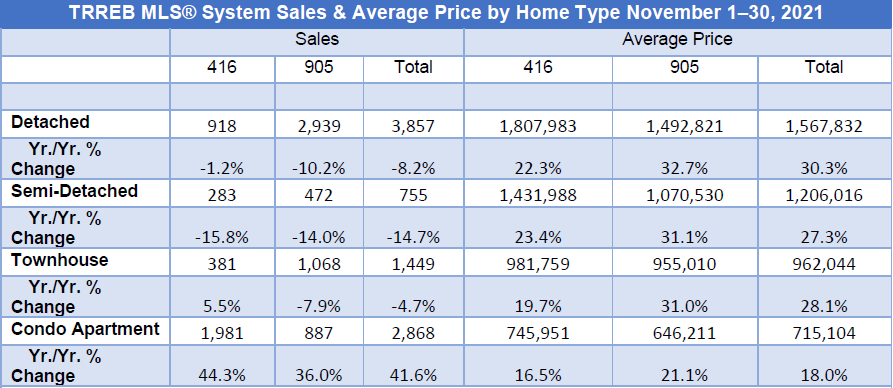

Average prices in the City of Toronto topped all the regional averages with detached homes reaching $1,807,983 on average, a 22.3% year-over-year increase. Similarly, semi-detached homes reached record territory averaging $1, 431,988 and townhouses hitting $981,759.

In the 905 regions of the GTA, detached homes sold for 32.7% more than a year earlier — averaging $1,492,821. Semi-detached homes averaged $1,070,530 and $955,010 for a townhouse.

Prices continue to be lower in the 905 regions compared to the City of Toronto, but as 2021 winds down that disparity is beginning to diminish.

The last time home prices accelerated at this pace was in the first quarter of 2017, according to TRREB. That was near the peak of the previous real estate boom in Toronto and Vancouver, and spurred the federal government to impose tougher borrowing rules and taxes on foreign buyers.

But today’s homebuying is mostly domestic, with investor purchases doubling in the past year, according to recent Bank of Canada research. That has increased competition and values in a market with a shortage of properties for resale.

As we move into the last month of 2021, condominium apartments are the largest housing type available to buyers, but that supply is also declining, while average sale prices for condominium apartments continue to rise.

Many buyers priced out of houses have turned to condos, which generally cost less. Coupled with more demand for condos as immigration numbers continues to rise. Compared with last year, condo resales are up 42 per cent in the city and surrounding suburbs.

“The condo and townhouse segments, with lower price points on average, will remain popular as population growth picks up over the next two years,” TRREB‘s chief market analyst, Jason Mercer commented.

In November, condo apartments sold for an average of $715,104 in the GTA, an 18 per cent rise from the same time last year. Price growth was the strongest in the 905 communities surrounding Toronto, up by 21 per cent year-over-year to $646,211. Condo prices also rose by 16.5 per cent in the city of Toronto to an average of $745,951. In the City of Toronto’s central core where most of the condo supply is located, the average price is now over $800,000.

While December is historically a slow selling month, that will not be the case this December. As we say goodbye to 2021, December will most likely mirror November’s activity. Especially with the abundance of anxious buyers looking to purchase in anticipation of the mortgage interest rates rising in the spring. Expect average sale prices will increase, inventory levels will continue to decline, especially for detached and semi-detached properties. Sales will take place super fast with multiple offers. The surrounding suburban regions will outpace the City of Toronto in sales and price growth.