After a hectic two years, in both real estate and the world at large, it seems we are now entering yet another new phase. Though the world is slowly returning to normal, those paying attention to the real estate market are left wondering – what does “normal” look like? How will things play out following the unprecedented market conditions of the last two years? No one has a crystal ball to know how things will play out, however, looking at past market conditions, and upcoming economic and legislative changes, it’s possible to make a more informed forecast for what the 2022 Toronto real estate market could look like.

In March, the Toronto real estate market continued at an active pace, though in some key areas it showed some signs of balancing. Overall, it was marked as the third-best March on record and the second-best first quarter on record. These are stellar results in the face of rising interest rates, the war in Ukraine and its global consequences, government legislation mostly directed against foreign buyers and investors, and a dire lack of inventory.

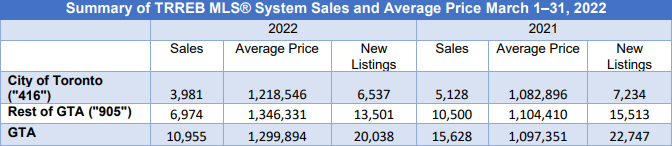

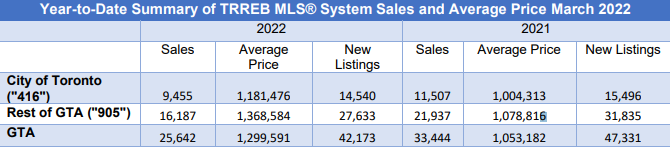

The Greater Toronto Area (GTA) home sales in March could not keep pace with last year’s record-smashing results. A total of 10,955 homes traded hands according to the Toronto Regional Real Estate Board (TRREB). This is a 30% decline from the 15,628 sold in March 2021, but a 20% month-over-month increase from February. Any comparison with March 2021 is pointless. During the first quarter of 2021, the resale market was being driven by the frenzy of the pandemic, with indiscriminate buying, particularly in suburban and secondary markets. Even without all the obstacles, it was still the third-best March on record as noted above.

While sales for all home types declined year-over-year, condos were down by the smallest margin of 17.6% with 3,154 units sold. Detached houses continue to lead the market in terms of sales volume at 4,884 transactions, however, saw the largest annual drop in sales, a decrease of 35.3%, followed by semi-detached houses (982 sales, down 33.4%) and townhouses (1,842 sales, down 29.9%).

Supply shortages continue to be a problem. In March a little over 20,000 new properties came to market, almost 12 % fewer than the 22,747 that came to market last March, but this is an increase of 41.6% from February. While still marking a 12% annual decline, the drop was well outpaced by sales which has taken pressure off of the GTA’s sales-to-new-listings ratio, easing to 70.5% from last month’s 72.2%.

“Competition between home buyers in the GTA remains very strong in most neighbourhoods and market segments. However, we did experience more balance in the first quarter of 2022 compared to last year. If this trend continues, it is possible that the pace of price growth could moderate as we move through the year,” said TRREB Chief Market Analyst Jason Mercer.

At the end of the month there were 10,167 active listings — down 4.1% year-over-year, but up 45.5% from last month, indicating the overall inventory of homes for sale is possibly rebounding from record lows. Based on the pace of sales, there were only 0.9 months of inventory in the entire greater Toronto area. In the City of Toronto, the situation was slightly better at 1.1 months of inventory due to the availability of condominium apartments. Given the population of the GTA which is approximately 6.7 million people, a more balanced market requires at least 20,000 properties monthly on a continuous basis available to buyers.

The average overall price across the GTA and for all housing types was $1,299,894. This marks one of the first decreases in price seen in quite a while, down from $1,334,544 in February. TRREB attributes this slight dip to a larger proportion of cheaper condo units in the sales mix. This also goes against the seasonal trend that would see prices begin to rise into the spring market. Despite the month-over-month dip, price growth remained in the double digits on a year-over-year basis, up 18% from $1,097,351 in March of 2021 underscoring a worsening affordability issue amid a tight market.

Detached homes sold at an average price of $1,920,018 and $1,632,832 in Toronto and the GTA respectively, both down from the previous month for a combined average of $1,697,396. Prices weren’t down across the board, however, as the condo market notably saw marginal price gains from last month.

An incredible statistic for March was all properties sold in eight days along with selling on average 113% of their asking price. Certainly, these statistics do not reflect a weakening market.

The growth in average sale price was stronger in the 905 regions as compared to growth in the City of Toronto. Overall prices in the City of Toronto increased by 15.8% and by almost 27% in the surrounding 905 regions. This pattern has continued through the pandemic, where less expensive homes offering more space were available.

Luxury properties continue to sell well. In March 1,165 properties priced $2 Million or more were reported sold. Year-to-date, 2,841 properties in this price category have been reported sold, 93% of these sales being detached properties in the City of Toronto and the 905 regions. Last year only 982 properties were reported sold in this price category.

TRREB President Kevin Crigger said that as the GTA experiences population and economic growth, policymakers need to make changes to ensure that there’s adequate housing

“Now is the time for governments to govern and focus on measures that are proven to increase housing supply,” said TRREB President Kevin Crigger. “The GTA population will experience rapid growth in the coming years as our region’s economic strength and diversity continue to attract people from around the world. To sustain this growth, we need adequate housing supply and choice.”

The impact of gradually increasing rates on the housing market won’t be instantaneous, but there will be some effects sooner than later. As interest rates rise, some potential buyers will fail to qualify for loans, lowering the demand on the market. Those who do qualify may need to look for lower-priced homes.

Recent government intervention in the resale marketplace may help remedy some of the major issues being experienced today however, it’s clear that they will not cause an immediate turnaround in market conditions. Without a large increase in supply, which is less than likely, even under these contradictory market forces, it will remain a seller’s market, but with less demand and fewer buyers competing for the same properties.

The consensus is for 2022 to see the market begin to slow and cool off, the start of a longer trend towards normalization that will take multiple years. This means 2022 will likely still be a very strong year for Toronto, if somewhat cooler compared to 2021.