The latest Greater Toronto Area (GTA) residential resale numbers are in, and this appears to be another very hot winter market. I am not even sure where to begin as we see record-breaking numbers in all areas month after month. While activity still lags last year’s frenzied levels, home sales in Toronto saw the second-highest February on record.

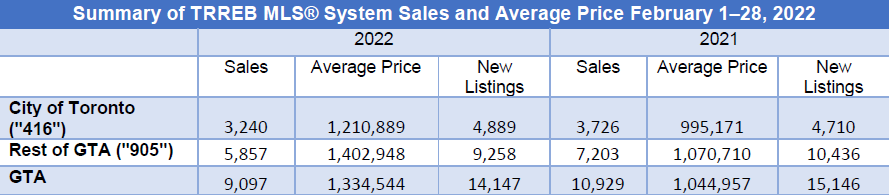

Home sales surged from January according to the Toronto Regional Real Estate Board (TRREB) – a total of 9,097 homes were reported sold last month. This is an increase of 61.4% over January however, a 16.8% decline in the number of sales compared to February 2021. This year-over-year decline in the number of sales is all due to supply and lack of inventory.

There was a bit of a boost to the much-needed supply situation in February. A total of 14,147 new listings came to market which was almost double the 7,979 properties that came to market in January, but still 6.6% fewer than the 15,146 new listings that became available to buyers last February. Heading into March there were only 6,985 available properties in the entire GTA, which was 2,000 higher than last month, but 20% fewer than at the same time last year. These are critically low numbers. Just to give some perspective, this is about a third of what was available at the beginning of 1997, and Toronto’s population has grown approximately 47% to roughly 6.3M people. As our population continues to grow, this supply issue is here to stay for the foreseeable future.

“We are close to provincial and municipal elections in Ontario. We know that housing affordability will be top of mind. Parties and individuals vying for political office must concentrate on bold and creative policies that will support increased and diverse housing supply to account for the current deficit and future population growth as immigration accelerates. History has shown that tax-based policies pointed at foreign buying and speculative activity, which seem to be the political preference, have had very little impact on the market simply because this type of activity accounts for a small share of overall market activity,” said TRREB CEO John DiMichele.

Competition between buyers remained tight enough to support double-digit price growth year-over-year and pushed Toronto’s resale prices to new records. The sales-to-new-listings ratio remains well ensconced in favour of the seller at 72.2%. In February the average sale price for all properties sold, including the sale of 2,772 condominium apartments, came in at an incredible $1,334,544— a year-over-year increase of 27.7%, and up 7.3% from the record $1,242,760 realized in January. This new record means the GTA average house price is now more than 60% higher than at the start of the pandemic. Just prior to the pandemic, the average price for all properties sold in the GTA was only $819,043!

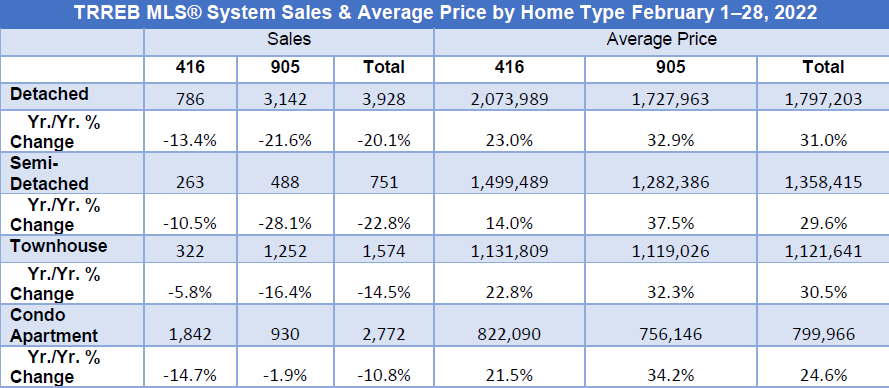

In all categories, records were broken. The greatest volume of sales is still in the pricey detached segment, led by activity in the surrounding 905 markets with 3,928 sales. An increase of almost 33% year-over-year to an of $1,797,203. In the City of Toronto, the average price of a detached home officially breached the $2M barrier in the City of Toronto, at $2,073,989, a 23% increase year-over-year.

Average sale prices continue to be higher in the City of Toronto as compared to the surrounding 905 region, but as has been the pattern since the beginning of the pandemic, the gap between the two is narrowing. In the City of Toronto, semi-detached homes are up to an average of $1,499,489 an increase of 14.6% year over year and townhomes reached an average price of $1,131,809 an increase of 22.8%. In the surrounding 905 area, semi-detached homes fetched an average price of $1,282,386 a 37.5% increase while townhomes increased to an average $1,119,026, a 32.3% rise year-over-year.

Condos, meanwhile, are hovering near the $800,000 threshold, with the average price coming in at $799,966 for the GTA. There was a total of 2,722 units sold in February, with 1,842 of those transactions concentrated in the City of Toronto. The average price for a condominium apartment in the City of Toronto now averages $822,090.

Luxury homes over the $4M price mark are also in high demand. During the first two months of this year sales have increased 53% year-over-year with 135 homes sold. There have been 7 condos sold over $4M which is a 250% increase over the same time last year.

Also worth noting, in a month full of new records, the days on market for all available properties was unbelievable. In February all properties (on average) that hit the market were reported sold in only 9 days. This is the norm for some neighbourhoods, however we have never seen this for the whole GTA. Also crazy to me, there was an average of 3.2 offers on every property.

As we entered March, the much-anticipated interest rate hike was upon us. On March 2nd the Bank of Canada increased rates by 0.25 percent, bringing the Bank rate to 0.5 percent. This was a modest increase and a move that’s expected to be the first of a series of small rate hikes this year in an attempt to tame inflation. Given all the other factors driving the Toronto and surrounding marketplace though, the impact on the residential resale market will be negligible. Substantial immigration levels and a continued lack of supply will have a countering effect on increasing mortgage costs. In fact, this may have a “fear of missing out” effect, driving people to buy now before rates get higher in the future. While there are several headwinds set to slow sales later in the year — namely rising interest rates — buyer competition is only expected to increase.