March 2024 brought continued vibrancy to the Greater Toronto Area (GTA) housing market, showcasing resilience amid economic fluctuations. Toronto’s housing trends reveal a mix of challenges and opportunities for buyers and investors, with encouraging numbers shaping expectations for the upcoming spring season.

In March 2024, the Toronto Regional Real Estate Board (TRREB) reported a strong upward trend in GTA home sales, totaling 6,560 homes sold. This represents a notable 17% increase from the previous month. However, compared to the same period last year, there was a 4.5% decline. The month also saw the sales-to-new-listings ratio (SNLR) rise to 50%, slightly surpassing February 2024’s SNLR of 49%. This uptick suggests that demand is growing slightly faster than available supply, giving sellers a slight advantage although the market is currently balanced overall.

On the inventory front, new listings were down 3% over February, but up 18.3% in the first quarter and 15% from March 2023.

“We have seen a gradual improvement in market conditions over the past quarter. More buyers have adjusted to the higher interest rate environment. At the same time, homeowners may be anticipating an improvement in market conditions in the spring, which helps explain the marked increase in new listings so far this year. Assuming we benefit from lower borrowing costs in the near future, sales will increase further, new listings will be absorbed, and tighter market conditions will push selling prices higher,” said TRREB President Jennifer Pearce.

In this current market, buyers are making informed decisions based on practical considerations rather than solely emotional impulses. With borrowing costs at elevated levels and stringent lending regulations, their purchasing ability is constrained. Even in situations with multiple offers, a trend that is becoming more common, homes are selling closer to their market value. This marks a significant shift from the hyperactive markets witnessed in 2020 and 2021.

According to monthly figures from TRREB, the MLS® Home Price Index (HPI) Composite benchmark home prices rose by 0.2% month-over-month and 0.3% year-over-year to $1,121,615.

The average GTA home price also demonstrated growth, marking a value of $1,121,615. This increase reflects a moderate 1.2% rise from the previous month, along with a 9.2% surge compared to January 2024, showcasing robust month-to-month dynamics. On an annual basis, the GTA’s average home price is also up 1.3% year-over-year.

“The average selling price edged up in comparison to last year as we moved through the first quarter of 2024. Price growth is expected to accelerate during the spring and even more so in the second half of the year, as sales growth catches up with listings growth and sellers’ market conditions start to emerge in many neighbourhoods. Lower borrowing costs in the months ahead will help fuel increased demand for ownership housing,” said TRREB Chief Market Analyst Jason Mercer.

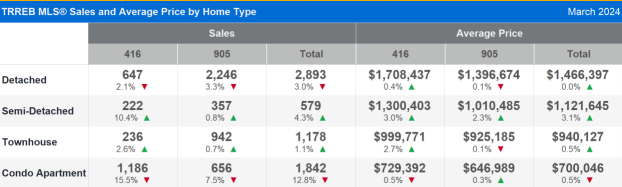

The average price of a detached home in the GTA was $1,466,397 in March 2024, which was flat from March 2023 and up by 1.6% month-over-month. Semi-detached home prices increased 3.1% year-over-year to an average price of $1,121,645, down 0.2% month-over-month.

Freehold townhouses are seeing prices at $1,039,124, up 0.2% year-over-year. Apartment prices are down 0.5% year-over-year to $700,046.

The Toronto area and its surrounding regions experienced an unexpectedly busy first three months of the year. The combination of warm winter weather and the anticipation of intensified competition following the Bank of Canada’s potential interest rate adjustments later in the year has motivated previously sidelined buyers to re-engage in the market with a renewed sense of purpose. It is anticipated we should see a seasonal pick-up in spring market activity in the GTA, and an even busier fall with prices on the rise if these trends continue.