Toronto’s housing market is showing signs it is on the rebound with rising competition in a tight market that pushed sales and home prices higher in March for the second consecutive month. Across the GTA, a total of 6,896 homes were sold in March according to the Toronto Regional Real Estate Board (TRREB). This marks a significant 44% increase from the 4,783 home sales sold in February. Although sales remained down over 36% from March 2022, still showing the toll rate hikes have taken on the market.

Traditionally, spring is the busiest time in the housing market, however, the number of listings is not keeping pace with the rising level of buyer interest. In March there were 11,184 new listings which is a 44.25% decline on a year-over-year basis, indicating that the market is seeing even tighter conditions than in March of last year.

“As we moved through the first quarter, Toronto Regional Real Estate Board Members were increasingly reporting that competition between buyers was heating up in many GTA neighbourhoods. The most recent statistics bear this out,” said TRREB President Paul Baron. “Recent consumer polling also suggests that demand for ownership housing will continue to recover this year. Look for first-time buyers to lead this recovery, as high average rents move more closely in line with the cost of ownership.”

With a market already struggling with limited inventory levels and this jump in sales activity creating even tighter market conditions, it is not surprising home prices are starting to creep up.

TRREB reported the home price index which excludes the highest-priced homes and is the industry’s preferred measure rose by 2.5% to $1,118,500 over the same period. The average price of all homes sold in March was $1,108,606 which is up 1.2% from February although still down 14.6% compared to March 2022.

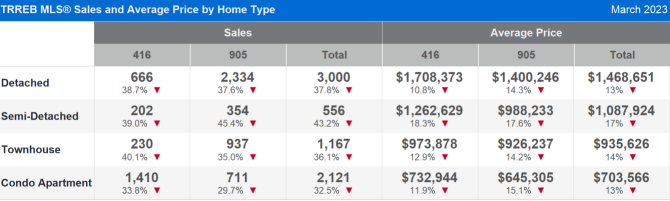

Detached homes saw the largest price jump in the GTA, increasing 4.9% to $1,468,651. Semi-detached homes sat at $1,087,924, townhouses at $935,626, and condo apartments at $703,566.

Condominium sales volume grew by the most in March with a 48% gain from February. This property segment tends to come at a lower price point than detached and semi-detached homes, where sales grew by 38% and 40% respectively. Townhome sales grew 42% month-over-month in March.

The Bank of Canada had a second consecutive pause with any interest rate hike this month which will give buyers more confidence in their borrowing costs. TRREB Chief Market Analyst Jason Mercer points to lower-fixed rate borrowing costs as adding fuel to the buyer demand fire, which is putting pressure on prices.

“Lower inflation and greater uncertainty in financial markets has resulted in medium-term bond yields to trend lower,” Mercer said. “This has and will continue to result in lower fixed rate borrowing costs this year. Lower borrowing costs will help from an affordability perspective, especially as tighter market conditions exert upward pressure on selling prices in the second half of 2023.”

As we look forward, it is anticipated the robust population growth could set a higher floor on Toronto home prices despite the rise in mortgage rates by keeping demand high in a low-supply market.

“As population growth continues at a record pace on the back of immigration, first-time buying intentions will remain strong. Because the number of homes for sale is expected to remain low, it will also be important to have substantial rental supply available,” DiMichele said. “Unfortunately, this is not something we have at the present time. We need to see a policy focus on bringing more purpose-built rental units online over the next number of years.”

It’s too soon to determine whether the modest monthly growth in sales and prices in March marks a Spring market turning point, time will tell.