Although June kicked off with a Bank of Canada interest rate cut, Greater Toronto Area (GTA) home sales failed to pick up in the way that some experts had forecasted they would. Many potential buyers are still staying on the sidelines despite the highly anticipated Bank of Canada interest rate cut.

“The Bank of Canada’s rate cut last month provided some initial relief for homeowners and home buyers. However, the June sales result suggests that most home buyers will require multiple rate cuts before they move off the sidelines. This follows Ipsos polling for TRREB, which suggested that cumulative rate cuts of 100 basis points or more are required to boost home sales by any significant amount,” said TRREB President Jennifer Pearce.

According to the figures from the Toronto Regional Real Estate Board (TRREB), there were 6,213 home sales in the GTA through in June 2024. This number is an increase of 4.2% from May, the first monthly increase since January, however, it is staggering 16.4% below the June 2023 level of 7,429 sales. Even with the Bank of Canada boost last month, Toronto’s housing market remained quiet compared with past years.

Inventory was on the rise last month with 17,964 properties put on the market in June. This is an increase of 9.3% from May to June on a seasonally adjusted basis and represents a 12.3% year-over-year rise. At the end of last month, there were 23,613 active listings – the highest volume since 2010.

The City of Toronto saw 2,236 sales in June, a 20.6 per cent decrease from a year ago. Throughout the rest of the GTA, home sales fell 13.8 per cent to 3,977.

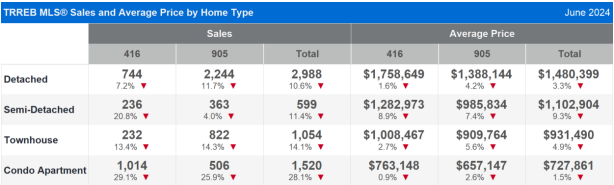

Most of June’s transactions were concentrated in the detached home segment, with 2,988 sales recorded, while there were 1,054 townhouse sales, 1,520 condo apartment sales, and just 599 sales of semi-detached homes.

The average GTA home price was $1,162,167 in June 2024. This is a small 0.3% decrease from the previous month’s price of $1,165,691 in May 2024. On an annual basis, the GTA’s average home price is down 1.7%.

The City of Toronto is still seeing a year-over-year increase in its average home price, a rare case amid a sea of red across the Greater Toronto Area. For June 2024, the City of Toronto’s average home price was $1,173,781, down 1.6% month-to-month yet up by 1.9% year-over-year.

“The GTA housing market is currently well-supplied. Recent home buyers have benefitted from substantial choice and therefore negotiating power on price. Moving forward, as sales pick up alongside lower borrowing costs, elevated inventory levels will help mitigate against a quick runup in selling prices,” said TRREB Chief Market Analyst Jason Mercer.

Across different housing types in the GTA reveal varying adjustments in average prices. Detached homes experienced a 1.7% decrease from the previous month and a 3.3% decline from last year, settling at an average price of $1,480,399. Semi-detached homes saw a more pronounced decrease of 6.0% month-over-month and 9.2% year-over-year, averaging at $1,102,904. Freehold townhomes followed with a 1.8% decrease from the previous month and a 6.1% decrease from last year, averaging $1,021,866. Condo apartments showed the least fluctuation, with a modest 0.4% decrease from the previous month to an average of $727,861, which is also 1.6% lower compared to a year ago.

In the City of Toronto, detached homes maintained an average price of $1,758,649 which is slightly down 1.6% year-over-year.

“Despite a temporary dip in home sales due to high interest rates, we know that strong population growth is driving long-term demand for ownership and rental housing. Ontario has set the goal of 1.5 million more homes on the ground by 2031. This is only possible if all levels of government ensure actionable solutions with sustained effort, including continuing to remove red tape, avoiding financial barriers to home construction, and minimizing housing taxes and development charges,” said TRREB CEO John DiMichele.

In summary, the City of Toronto is still seeing a year-over-year increase in its average home price due to the slump in Toronto condo sales, which are down 29% year-over-year in the city. The drop in condo sales by 29% means that fewer of these typically lower-priced properties are included in the overall sales data. This skews the average price higher as a larger proportion of the transactions are made up of more expensive detached homes and other property types.

Meanwhile, increasing inventory levels in Toronto’s housing market have created significant implications for buyers and sellers alike. For buyers, greater inventory means more options and potential leverage in negotiations, possibly leading to lower prices as supply outpaces demand. This shift toward a buyer’s market presents opportunities for those entering or upgrading in the housing market.

Conversely, for sellers, higher inventory levels can result in longer times on the market and potentially lower sale prices, necessitating more competitive pricing. Sellers should be prepared to adjust their expectations and pricing strategies to align with the current market dynamics.

In June 2023, the average property’s days on the market were 19. In June 2024, that has risen to 30. This month, the average sales price to listing price ratio was 100%, meaning the average home sold for its asking price.

The market is poised for potential recovery as borrowing costs decrease further and economic conditions stabilize. With a well-supplied market, buyers have the upper hand for now. However, sellers can still benefit from the strong long-term demand driven by population growth and urban development goals. For investors and homebuyers, this period offers a strategic window to capitalize on increased inventory and favourable negotiating conditions. The long-term outlook remains positive, with population growth and government efforts to support housing development ensuring sustained demand in the GTA real estate market.