As expected, the June 2022 resale housing numbers for the Greater Toronto Area (GTA) are not as robust as June 2021 with tougher borrowing costs continuing to mount. The latest numbers reveal both the number of homes sold and prices are continuing in downward trend in the GTA in the short term.

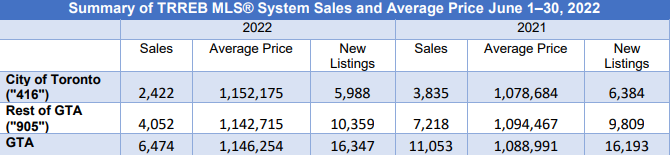

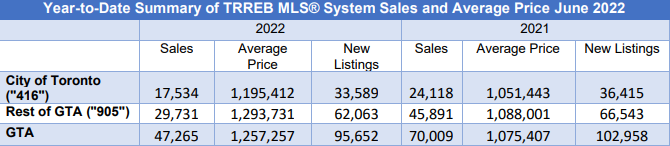

A total of 6,474 homes sold last month in the GTA, according to the Toronto Regional Real Estate Board (TRREB), down a considerable 41% from last year’s record-breaking activity of 11,053 homes. This is also a drop of 11% from May 2022 sales levels which can partly be attributed to the seasonal nature of the market, and it is anticipated the cooler market conditions will persist through the slower summer months.

“Home sales have been impacted by both the affordability challenge presented by mortgage rate hikes and the psychological effect wherein home buyers who can afford higher borrowing costs have put their decision on hold to see where home prices end up. Expect current market conditions to remain in place during the slower summer months. Once home prices stabilize, some buyers will re-enter the market despite higher borrowing costs,” said TRREB President Kevin Crigger.

The average sale price for all home types in the GTA was $1,146,254, sliding 5.48% from May however prices are still up 5.3% higher than the average sale price of $1,088,991 achieved last June. Prices have been slowly sliding since their peak earlier this year though. February was the price peak during the pandemic when 9,044 properties were reported sold achieving an eye-popping sale price of $1,334,142. March saw more sales of 10,902 homes trading but could not sustain the unprecedented average price. March’s average sale price dropped to $1,299,468. Higher mortgage interest rates kicked in April and since then both sales and average sales prices have been declining in the GTA.

Slower sales and price growth were more pronounced outside the city. In the surrounding GTA areas transactions fell 43.8% year over year with 4,052 deals, while the average price rose just 4.4% to $1,142,715. In the City of Toronto, a total of 2,422 sales occurred, down 36.8% compared to the same time frame in 2021, while the average price rose 6.81%

As restrictions have eased, buyers are no longer looking for the space and safety that ground-level properties offered in suburban areas. In June, every housing type in the City of Toronto achieved average sale prices substantially higher than its corresponding counterparts in the 905 regions.

Average prices by home type in the City of Toronto for June reached $1,737,012 for detached homes which is an increase of 2.4% year-over-year, $1,343,378 for semi-detached an increase of 5.9%, and $771,267 for condos an increase of 7.4%.

In suburban regions of the GTA, better known as the 905, the average price was more than $1,361,862 for a detached home which is an increase of 2.4% year-over-year, $987,009 for semi-detached an increase of 7.81% and $692,598 for a condo an increase of 13.2%.

Interestingly, in June the average number of days on market for all properties was just 15 days, only 2 days more than the 13 days it took last June. And in the City of Toronto all properties averaged 101 % of their asking price. These numbers illustrate there continue to be many buyers in the marketplace searching to purchase homes in the Toronto and surrounding region despite the rising mortgage rates. As more immigrants settle in the greater Toronto area the demand will continue to grow and create the same market pressures that were present before and during the pandemic. This will not be apparent until the Bank of Canada has inflation under better control and mortgage interest rates stop increasing.

As the number of homes sold dropped off, the new listing supply remained little changed, easing the inventory crunch that has long plagued the market. A total of 16,347 new listings came to market — an annual increase of 1%, while the month ended with 16,293 active listings, a 42.5% boost. As a result, the sales-to-new-listings ratio came in at 62.1%, still considered at the lower end of a sellers’ market, but a dip from May’s ratio of 65.1%. Those currently in the market are enjoying some of the most balanced buying conditions seen in years.

“Listings will be an important indicator to watch over the next few months. With the unemployment rate low, the majority of households aren’t in a position where they need to sell their home. If would-be sellers decide to take a wait-and-see attitude over the next few months, it’s possible that active listings could trend lower as well. This could cause market conditions to tighten somewhat, providing some support for home prices,” said TRREB Chief Market Analyst Jason Mercer.

The rental market in Toronto is soaring with inflation and interest rates continuing to climb, coupled with an undersupplied housing market, supply chain issues, and immigration on the rise. The average monthly rental rate in June was $2,463. A one-bedroom rental in the city is $2,192, up 2.77% month-over-month and 18.49% year-over-year, while a two-bedroom is $3,115, up 3.76% month-over-month and 23.37% year-over-year.

The bottom line, we experienced unprecedented times in the housing market over the past two years. House prices were on fire last year into early 2022. Over the last couple of months, the market continues to move away from its frenzied pace with the recent increases in interest rates. The Bank of Canada is aggressively trying to combat runaway inflation, which is expected to hit 8% this month. With the most recent increase of a full percentage point – the benchmark interest rate is now at 2.5% from .25% at the beginning of 2022. This means less purchasing power for prospective buyers, but the conditions are shifting in their favour as homes are often not garnering the frantic bidding wars they would have months ago. And, with more listings now on the market, buyers who had put their search on pause may find this to be a good time to reengage with our market.

Even though the market is still in sellers’ territory with 2.5 months of inventory, sellers need to adjust their expectations to achieve success in selling their homes. Instead of a seller’s home selling in a couple of days with multiple bids, it will likely require more time before offers and possibly even showings begin to materialize. Pricing is key and needs to be in line with recent relevant closed sales rather than sales earlier in the year

Home prices are expected to hold through the remainder of 2022 in the greater regions of Toronto with the continued household formation from peak millennials who are reaching the traditional home-buying age, high levels of immigration, a healthy job market, and the high construction cost of new homes.

In the TRREB June Market Report, CEO John DiMichele commented “Our region continues to grow because we attract people and businesses from all around the world. All of these people will require a place to live, whether they choose to buy or rent. Despite the shorter-term impact of higher borrowing costs, housing demand will remain strong over the long-term, as long as we can produce homes within which people can live. Policymakers at all levels need to make this their key goal.”

Change brings opportunity and, right now, there is opportunity for both buyers and sellers in our market. Let me know how I can help you achieve success as you consider making a purchase or selling your home.