January 2025 presented a dynamic yet evolving landscape for the Toronto real estate market. While overall home sales in the Greater Toronto Area (GTA) declined year-over-year, an increase in new listings and a more moderate pace of price growth have created a market shifting toward balance—if not favouring buyers in certain segments.

“A growing number of homebuyers will take advantage of lower borrowing costs as we move toward the 2025 spring market, resulting in increased transactions and a moderate uptick in average selling prices in 2025. However, the positive impact of lower mortgage rates could be reduced, at least temporarily, by the negative impact of trade disruptions on the economy and consumer confidence,” said TRREB Chief Market Analyst Jason Mercer.

Toronto Regional Real Estate Board reported 3,847 home sales in January, reflecting a 7.9% decrease compared to January 2024. Despite the annual decline, sales improved on a seasonally adjusted basis from December 2024, suggesting some resilience in market activity. However, new listings surged by nearly 49% year-over-year, reaching 12,392 properties, creating an environment where buyers have significantly more choice.

This influx of inventory has tempered price growth and increased competition among sellers. The average selling price across all property types was $1,040,994, marking a 1.5% annual increase but a 2.5% drop from December—the lowest monthly average recorded since January 2024. The benchmark home price rose modestly by 0.2% year-over-year to $1,070,100, but rising inventory levels have applied downward pressure on pricing – particularly in the condominium market.

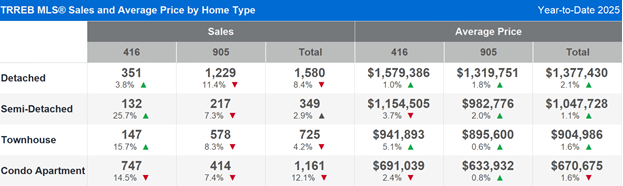

The market continues to show notable divergence based on property type and location. While sales of detached, semi-detached, and townhomes in the City of Toronto increased by 15% year-over-year, similar property types in the 905 Region saw a 9% decline. The condominium sector, however, remains under pressure, with the City of Toronto condo sales down 14.5% annually and the average selling price decreasing 2.5% to $691,039. In contrast, the 905 Region’s condo prices held steady at $633,932, though sales still declined.

At the end of January, there were 17,157 active listings in the GTA, a staggering 70% increase over the previous year. However, more than 30% of these listings were relisted properties—homes previously on the market but did not sell. This suggests that while inventory is growing, not all is fresh supply, and many sellers are adjusting their pricing strategies after struggling to attract buyers in late 2024.

Despite multiple rate cuts by the Bank of Canada in 2024, the anticipated resurgence in buyer activity has yet to fully materialize. While lower borrowing costs should, in theory, encourage more buyers to enter the market, many remain hesitant due to economic uncertainty, affordability concerns, and the potential for further rate adjustments. High inventory levels mean buyers have greater choice, often leading to longer selling times and more price negotiations. Investor confidence in the condo market has weakened, as declining rents and softening resale values make condo ownership less attractive. The federal government’s recent decision to increase the insured mortgage cap to $1.5M was expected to allow more buyers with smaller down payments to enter the market, but its impact has been muted so far.

The condo market faces significant structural challenges. Many condo units currently on the market are investor-owned, and many investors are offloading their properties as rental rates soften and mortgage costs remain high, making condo investments less profitable. Additionally, the pre-construction assignment market is flooded with units selling for less than their original purchase price, indicating financial strain among some investors. Compounding this issue, a wave of new condo completions in 2025 and 2026 will further increase supply, putting additional downward pressure on prices. While detached and semi-detached home prices may recover more quickly, the condo market’s challenges may take longer to resolve.

A shifting buyer mindset is also influencing the market. First-time buyers remain a key segment, accounting for 42% of those intending to purchase in 2025. However, the average time spent renting before buying has increased to 8.5 years, a clear reflection of the growing affordability gap. Meanwhile, downsizers and baby boomers continue to be active in the market, particularly in urban areas where demand for low-maintenance, high-quality housing remains strong.

Although January began with uncertainty, early February data suggests that sales activity is picking up momentum, with increased transactions toward the end of the month. This could indicate that buyers have now adjusted to market conditions and are starting to re-enter, particularly in the more resilient segments of the market. Looking ahead, TRREB forecasts 76,000 home sales in 2025, a 12.4% increase from 2024, driven by lower borrowing costs and pent-up demand. The average selling price is expected to reach $1,147,000, representing a 2.6% annual increase, with stronger price growth anticipated in the low-rise housing segment compared to condominiums.

“As we look to the future, prioritizing housing diversity and supply remains paramount. Encouraging the development of missing-middle housing—such as townhomes, duplexes, and low-rise multi-unit buildings—is critical to delivering a range of attainable options for individuals and families. Purpose-built rentals also play a vital role in ensuring everyone has access to a place they can call home,” said TRREB President Elechia Barry-Sproule.

While the market moves through this period of transition, its trajectory will be shaped by several key factors. If interest rates continue to decline, more buyers may return from the sidelines, fueling increased sales and moderate price growth. However, elevated inventory, affordability constraints, and economic uncertainties will play a significant role in influencing buyer and seller behavior. Sellers must be strategic in pricing their homes to remain competitive, while buyers have a rare opportunity to negotiate favorable terms in select segments of the market. While challenges remain, the Toronto real estate market continues to adapt, and for those who understand its evolving dynamics, there are opportunities to be found.