The latest housing market data from the Toronto Regional Real Estate Board (TRREB) continues to perform well above what is seasonally typical in the dead of winter. The latest numbers reveal January 2022 sales were the second-highest in history for the month. Once again, a few new records were set along with a few surprises by the Toronto and surrounding suburban area residential resale market in January.

In line with the long-term developing trend, 2022 kicked off with an extremely scarce supply. January saw 7,979 properties come to market; a decrease of 15.5 percent compared to the 9,438 that came to market last January. Sales and new listings moved in relative lockstep, depleting overall active inventory to just 4,140 homes available for sale at the end of January — plummeting 44 percent to the lowest level in more than two decades. It appears supply will continue to be the inhibiting market force in 2022.

With this dire lack of homes available for sale, it should come as no surprise that sales volume was down in January compared to last year. There are lots of buyers out there, they are just having difficulty getting a deal done with so few homes available for sale.

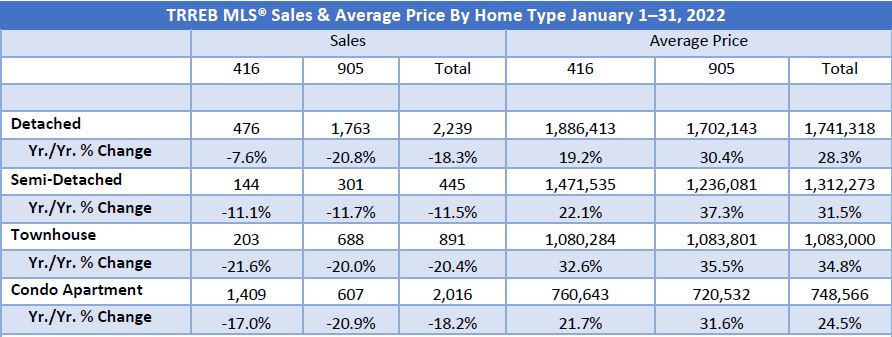

There were 5,636 sales in the Greater Toronto Area (GTA) for the month of January, a decline of 18.2 percent compared to the 6,888 property sales last year. Also, interesting to note of the 5,636 properties sold, 2,016 (36 percent) were condominiums.

Most noteworthy, this prolonged extreme supply-and-demand imbalance drove home prices to an all-time high. The average price for all property types sold in the GTA came in at an astounding $1,242,793, surpassing the previous record of $1,163,210 set in November last year. This is a 28.6 percent year-over-year increase from last January when the average sale price came in at only $966,068. Overall, the GTA remains in a sizzling sellers’ market with a sales-to-new-listings ratio of 72.9 percent.

As has been the case throughout the pandemic, the 905-area markets experienced the strongest price growth, up 31.6 percent to an average of $1,355,298, with a total of 3,389 homes sold in those areas. This is a decline in sales volume of 19.9 percent year-over-year. In the City of Toronto, homebuyers are now facing an average price of $1,073,111, an increase of 24 percent year-over-year with 2,247 homes sold, a 15.2 percent drop from last January.

As a result of these increases, the gap in housing prices between the City of Toronto and the suburban 905 regions has reduced significantly. With more people working from home and needing more interior and outdoor space, this pattern will continue throughout the foreseeable future.

Detached homes sales continue to drive the market. There were 2,239 detached homes sold in the GTA during January 2022. Of these, 476 were sold in the City of Toronto with an average price of $1,886,413. In the surrounding 905, there were 1,763 detached homes sold with an average price of $1,702,143.

The resurgence in condo sales continues into 2022. A year ago, condominium apartment sale prices in the City of Toronto resulted in a negative variance, down 8 percent compared to 2020. In January 2022, condominium apartment prices rose by 21.7 percent to $760,643. Even more astonishing, in Toronto’s central core 966 apartments were reported sold in January with an average sale price of over $800,000. What used to be an affordable housing type option is becoming quite pricey. In the 905 regions, the average price of a condominium apartment came in at $720,532, a 31.6 percent increase over last January. And in one year the available supply of condominium apartments has declined 53 percent.

Looking towards the rest of 2022, TRREB is expecting a stronger-than-normal year. Total home sales in the GTA are expected to reach 110,000, which would be a dip compared to last year’s record-breaking 121,693 home sales, though still a robust market in a historical sense. The average selling price of all housing types is expected to hit a new record at $1.225 million, seeing a 12 percent boost from last year, according to TRREB’s 2022 market outlook.

Those on the hunt for a home this year in the GTA will notice there is an unwillingness among existing homeowners not to list their property due to a “vicious cycle”, where the fear is they will not be able to find another home that meets their needs.

Another influence with the market in the coming year, “Immigration into Canada and the GTA is expected to be at or near record levels in 2022. All of these people will require a place to live,” said TRREB president Kevin Crigger in a press release. “Unfortunately, the supply of listings will remain constrained, sustaining strong competition between buyers and double-digit growth in selling prices.”

While improving labour market conditions and population growth will prop up real estate demand, all eyes are on the Bank of Canada’s impending rate hiking cycle, which could start as early as March, to cool conditions in the second half of the year. However, a higher cost of borrowing may have less of an impact than expected with stress test policies already in place. And given the level of demand and the lack of supply the impact of higher mortgage interest rates will likely be moderate. Those buyers struggling to qualify today may be forced out of the market or must look at smaller properties, especially first-time buyers, but there are still many who are intent and capable of purchasing a home.

“It is clear that 2022 is starting off the way 2021 ended in terms of the relationship between demand and supply in the GTA housing market,” says TRREB CEO John DiMichele. “We have provincial and municipal elections this year in Ontario. These are the levels of government whose policies impact real estate development the most. With this in mind, it will be very important for voters to understand exactly what parties and individuals vying for public office proposes to do to alleviate the lack of inventory and housing choice in the GTA in the years to come.”