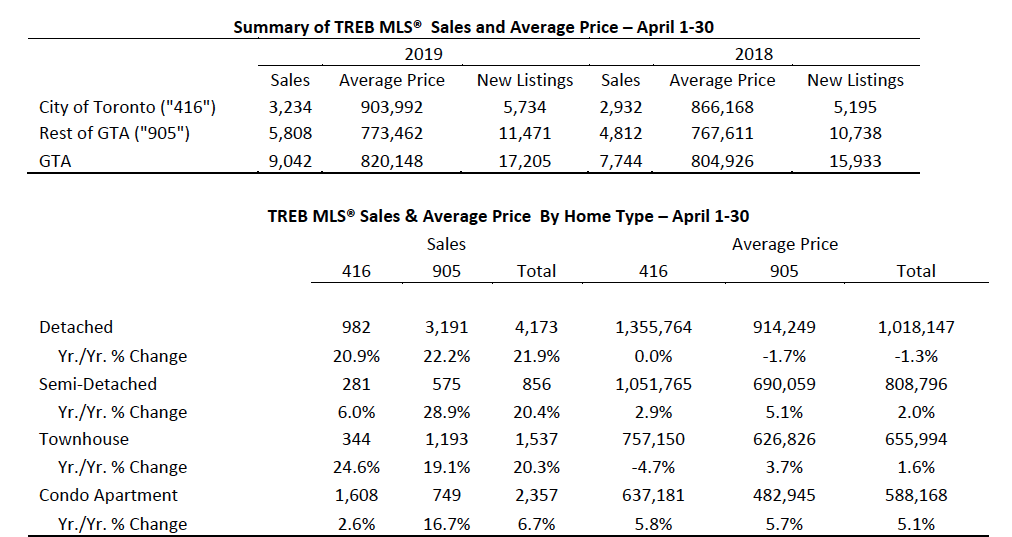

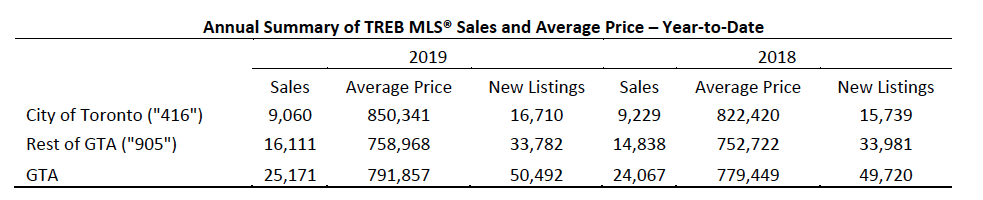

Positive news has been released from the Toronto Real Estate Board (TREB) with a substantial year-over-year increase in home sales in April 2019. The number of residential transactions rose by 16.8 per cent to 9,042 compared to 7,744 in April 2018 when sales were weak after the implementation of the mortgage stress test. The number of sales were up 11.3 per cent on a month-over-month basis from March 2019.

New listings of homes for sale were also up year-over-year by 8 per cent. The annual growth rate for new listings was much lower than that reported for sales. This suggests market conditions continue to tighten which points toward an increase pressure on price growth.

This improvement in April sales comes on a low base from last year and follows sluggish performance in the first three months of this year. TREB comments that some of this growth in April most likely represents “catch up” from the slow start to the year.

The year-over-year price growth edged up in April relative to the first three months of the year due to tighter market conditions. The average sale price for all types of homes rose 1.9 per cent over April 2018 to $820,148. And in the City of Toronto, that number is now $903,992. This is the strongest annual rate of growth in 2019 and the average selling price was also up by 1.1 per cent over March 2019.

“While sales were up year-over-year in April, it is important to note that they remain well-below April levels for much of the past decade. Many potential home buyers arguably remain on the sidelines as they reassess their options considering the OSFI-mandated two percentage point stress test on mortgages. Longer term borrowing costs have trended lower this year and the outlook for short-term rates, for which the Bank of Canada holds the lever, is flat to down this year. Unfortunately, against this backdrop, we have seen no movement toward flexibility in the OSFI stress test,” said Jason Mercer, TREB’s Chief Market Analyst.

According to TREB, the sales of detached houses were up by 22 per cent in April over last year, however the average prices fell 1.3 per cent. This price decline was due to a 1.7 percent drop in detached house prices in the 905-region, while prices in the City of Toronto remained flat. The detached market segment which has the highest price point on average, has been hardest hit by measures such as the OSFI stress test.

In the City of Toronto, the average price for a detached house was $1,355,764 in April. In the 905-region surrounding Toronto detached prices averaged $914,249.

Price growth continued to be driven by the condominium apartment segment last month. Sales of condominium units increased 6.7 per cent in April and the prices were up 5.1 percent year-over-year to an average of $588,168 in the GTA according to TREB.

The Bank of Canada maintained the key interest rate in April and made no mention of any increases the foreseeable future keeping longer term borrowing trending lower this year.

The condominium apartment rental segment continues to experience very tight market conditions. Year-to-date condominium rental transactions for one-bedroom and two-bedroom apartments were up by 10.2 per cent and 9.7 per cent respectively compared to this period in 2018. Average year-to-date rents for one-bedroom apartments were up by 7.3 per cent on an annual basis to $2,150. Two-bedroom apartment rents were up by 4.1 per cent to $2,815 over the same period.

Even though home sales have softened over much of the past two years, the housing supply issue continues to exist in the Greater Toronto Area. The Ontario government announced last week it’s Housing Supply Action Plan with the effort to boost the supply of housing in the Toronto region. This plan announced new measures to speed up approvals of development applications, reduce density requirements in new suburban developments and increase the power of its land use appeal tribunal to make final decisions. TREB’s President, Garry Bhaura said TREB welcomes the Plan and provided input to the provincial government on the Plan through submissions and participation on working groups.

Hopefully spring is here to stay, and the market will continue to improve with more good listings introduced in May!