February 2024 showcased vibrant activity in the Greater Toronto Area (GTA) real estate market, with both home sales and new listings displaying impressive annual and monthly increases. Additionally, selling prices exhibited an upward trend compared to the previous year. These positive indicators reflect the enduring strength of the regional economy and the consistent population growth, which continue to drive demand for housing. While home sales didn’t surpass the record set in February 2021 due to higher borrowing costs, the market is witnessing a resurgence in activity.

“We have recently seen a resurgence in sales activity compared to last year. The market assumption is that the Bank of Canada has finished hiking rates. Consumers are now anticipating rate cuts in the near future. A growing number of homebuyers have also come to terms with elevated mortgage rates over the past two years. To minimize higher monthly payments, some buyers have likely saved up a larger down payment, chosen to purchase a less-expensive home type, and/or looked to a different location in the GTA,” said TRREB President Jennifer Pearce.

According to the Toronto Regional Real Estate Board (TRREB), 5,607 home sales were reported throughout the GTA in February – a sizeable 17.9% jump compared to the same month last year. Even after accounting for the leap-year effect, sales were up by 12.3% year-over-year.

In the City of Toronto, there were 1,971 sales last month, up 13.7% from February 2023. Throughout the rest of the GTA, home sales were up 20.4% to 3,636.

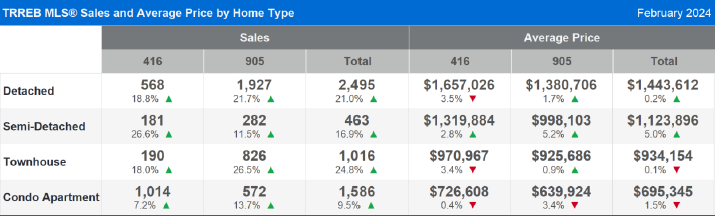

Sales were up across all housing categories throughout the GTA, led by a 24.8% year-over-year gain for townhouses. The number of detached homes that changed hands was up 21%, followed by a 16.9% gain for semi-detached and a 9.5% increase for condo apartments.

New listings also saw a substantial annual rise, providing buyers with increased options. In February 2024, new listings increased to 11,396 new listings, a 36% increase from the 8,367 new listings in February 2023. However, February sales dipped slightly on a seasonally adjusted month-over-month basis after two consecutive monthly increases, with new listings remaining flat from January. Such fluctuations are common, especially when the market is approaching a transition point.

Despite the dynamic market conditions, home selling prices in February 2024 remained relatively stable year-over-year, with the MLS® Home Price Index Composite benchmark (which excludes the highest-priced transactions) experiencing a slight 0.4% uptick.

The average GTA home price has seen a more pronounced rise, standing at $1,108,720. This represents a slight 1.2% increase from the preceding year, accompanied by an 8.0% increase within the span of a month when compared to January 2024.

The average price of a detached home in the GTA was $1,443,612 in February 2024, a 0.3% increase year-over-year and up by 6.9% month-over-month. Semi-detached home prices increased 5.1% year-over-year to an average price of $1,123,896, up 8.2% month-over-month. Freehold townhouses are seeing prices at $1,034,011, down 1.6% year-over-year. Condo apartment prices are also down 1.4% year-over-year to $695,345.

Looking at the City of Toronto, the average price in February of detached homes was $1,657,026 which is a 3.5% decrease year-over-year, semi-detached homes were $1,319,884 up 2.8% year-over-year, townhomes $970,967 down 3.4% year-over-year and condo apartment $726,608 down a marginal 0.4% to $726,608.

“As we move through 2024, an increasing number of buyers will re-enter the market with adjusted housing preferences to account for higher borrowing costs. In the second half of the year, lower interest rates will further boost demand for ownership housing. First-time buying activity will also be a contributing factor, as many renters look to trade high monthly rents for a long-term investment in which they can live and build equity,” said TRREB Chief Market Analyst Jason Mercer.

Strategic buyers are looking to make a purchase now rather than later anticipating the interest rate cuts later this year will boost demand, putting upward pressure on prices again.

John DiMichele, CEO of TRREB, emphasized the importance of addressing housing affordability concerns, stating, “Population growth has been at a record pace and with the anticipated lower borrowing costs, the demand for housing – both ownership and rental – will also increase over the next two years. Unaffordable housing not only has a financial impact but also a social impact. Recent research conducted for TRREB by CANCEA in our 2024 Market Outlook and Year in Review report underscores the negative impact of unaffordable housing on people’s mental health and life satisfaction. It’s comforting to see that there has been some real building happening in the GTA and that the provincial government is rewarding those municipalities that are working to eliminate the red tape and meet those homeownership needs.”

Overall, the outlook for the GTA real estate market remains promising, with continued demand fueled by economic resilience, population growth, and evolving consumer preferences amidst changing interest rate dynamics.