The Greater Toronto Area (GTA) housing market experienced a transitionary year in 2024. Annual sales were up slightly compared to 2023, and new listings were up significantly year-over-year. Buyers benefited from substantial negotiating power on price, especially in the condominium apartment market. Average selling prices in 2024 remained stable with a less 1% decline in comparison to 2023.

For the full year, 67,610 properties changed hands in 2024—a modest 2% improvement over the 65,877 sales recorded in 2023. To put these figures into context, annual sales in the decade leading up to the COVID-19 pandemic averaged over 90,000, peaking at 121,712 in 2021 during the pandemic-fueled market surge. By comparison, 2024’s sales levels are reminiscent of the late 1990s, a sobering indicator of the market’s current challenges.

“Borrowing costs were top of mind for home buyers in 2024. High interest rates presented significant affordability hurdles and kept home sales well below the norm. The housing market did benefit from substantial Bank of Canada rate cuts in the second half of the year, including two large back-to-back reductions. All else being equal, further rate cuts in 2025 and home prices remaining below their historic peaks should result in improved market conditions over the next 12 months,” said the Toronto Regional Real Estate Board (TRREB) President Elechia Barry-Sproule.

Looking at just December 2024, GTA home sales ended the month down 1.8% year over year with just 3,359 properties changing hands. In stark contrast, October and November saw home sales surge 44% and 40% over the same months in 2023.

December’s underwhelming performance can be attributed to several factors. Despite the Bank of Canada’s December 11 rate cut to 3.25%, fixed mortgage rates remained above 4%, disappointing buyers who had hoped for more substantial relief. Compounding this, the Federal government’s increase in the insured mortgage loan cap to $1.5 million came into effect on December 15, too late to influence December sales activity during the holiday season.

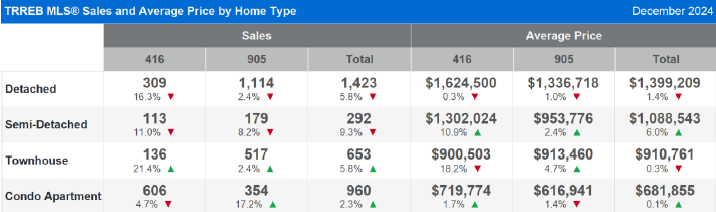

The average sale price for December was $1,067,168, down 1.6% from $1,084,757 in December 2023. However, this average price masks significant variability across property types. Condominium apartments accounted for nearly 30% of all sales, with an average price of $681,855. Excluding condominiums, detached homes averaged nearly $1.4 million, and semi-detached homes exceeded $1 million. In Toronto proper, detached homes averaged over $1.6 million, and semi-detached homes surpassed $1.3 million. Notably, while sales activity has softened, average prices have shown resilience, reflecting ongoing affordability challenges.

Most of December’s transactions were concentrated in the detached segment, with 1,423 sales recorded (down 5.8% from last year), compared to 960 condo apartment sales (up 2.3%), 653 townhome sales (up 5.8%), and only 292 sales of semi-detached homes (down 9.3%).

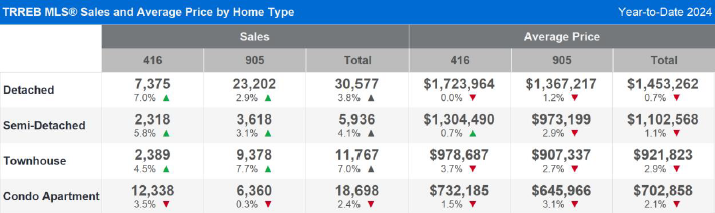

Looking at the total year numbers for 2024, the average home price was $1,117,600, down 0.8% from 2023’s average price of $1,126,263. Market conditions were tighter for ground-oriented housing and selling prices held up better in these segments as a result. Price declines were more notable for condo apartments.

“Market conditions varied by market segment in 2024. Sales of single-family homes, including detached houses, increased last year, whereas condo apartment sales were down. Many would-be first-time buyers remained on the sidelines, anticipating more interest rate relief in 2025. The lack of first-time buyers impacted the less-expensive condo segment more so than the single-family segments,” said TRREB Chief Market Analyst Jason Mercer.

While new listings were up 16% year-over-year to 166,221. and the discrepancy between slow sales and a boost in listings provided buyers with considerable choice in the marketplace, which also helped to put a lid on price growth. New and active listings surged in the month of December by around 20% (to 4,681) and 48% (15,393), year over year continuing the trend of a well-supplied market into 2025

Looking ahead to 2025, the outlook is cautiously optimistic. Economic growth and improving borrowing conditions are expected to support moderate increases in sales and prices. The Bank of Canada is anticipated to lower its overnight rate further, potentially reaching 2.25% to 2.5% by year-end. This would likely bring five-year fixed mortgage rates down to around 4%, a welcome improvement but still far from the historically low rates of recent years. Combined with the expanded insured mortgage cap, these factors are expected to encourage more activity in the resale market, particularly for homes priced under $1.5 million.

Sales for 2025 are forecasted to rise by 6% to 8%, reaching between 72,600 and 74,000 transactions. While this would represent progress, it would still fall short of pre-pandemic levels. Average sale prices are expected to grow modestly by 3% to 5%, starting at $1,117,600 in January and ending the year between $1,150,000 and $1,172,000.

Demand remains robust, driven by rapid population growth in the Toronto region. However, affordability remains the primary challenge. Household incomes have not kept pace with rising borrowing costs and housing prices. Even with lower borrowing costs expected in 2025, households will need incomes exceeding $250,000 to qualify for an average-priced home in the region.

The year ahead begins on a more optimistic note than 2024, albeit with lingering uncertainties. Political developments in Canada and the United States could impact economic conditions, particularly in Southern Ontario. Despite these external factors, improving affordability and borrowing conditions should create a more favorable environment for buyers. While challenges persist, the 2025 market is poised for gradual improvement, offering renewed opportunities for those ready to navigate its complexities.