The number of home sales in the Greater Toronto Area (GTA) continued to fall in August. Hopefully this is the last month of one of the worst residential resale market periods since the early 1990’s. The figures from the Toronto Regional Real Estate Board (TRREB) show only 4,975 home sales recorded for the GTA, marking a 5.3% decrease over the 5,251 sales reported in August 2023. In July, the same year-over-year metric was up 3.3%. Year-to-date 46,864 sales have been recorded. Last year at this time 49,049 homes of all types were reported sold in the GTA and 2023 was not a robust year by any means.

To grasp the extent of the current decline in the resale market, it’s important to consider how much has changed since the peak of the pandemic market in February-March 2022. Last year 65,879 homes were reported sold. At the current pace, Toronto and the surrounding region are expected to see about 63,000 properties sold by the end of 2024 – approximately 4.5% fewer than in 2023. Between 2011 and 2020, pre-pandemic, the average number of annual resale transactions in the region was over 90,000, with a high of 113,040 in 2016 and a low of 78,017 in 2018 following the introduction of Ontario’s foreign buyer tax. During that period, the Bank of Canada’s benchmark interest rate stayed under 1.75%, mostly below 1%. Today it’s at 4.25%.

Also keep in mind with these numbers, in 2011 the GTA population was 5.59 million and by 2020 it had grown to 6.2 million—an increase of about 11%. Currently, the GTA’s population stands at 6.43 million and continues to rise. Despite a population increase of nearly 1 million since 2011, home sales have dropped by 30% compared to the annual average from 2011 to 2020. This decline mirrors levels not seen since the early 1990s recession, when the GTA’s population was just over 4 million. Surprisingly, more sales occurred between 1996 and 1999 than are expected in 2024.

“The Bank of Canada’s rate cut announced on September 4 will lead to a further improvement in affordability, especially for those using variable rate mortgages. First-time buyers are especially sensitive to changes in borrowing costs. As mortgage rates continue to trend lower this year and next, we should experience an uptick in first-time buying activity, including in the condo market,” said (TRREB) President Jennifer Pearce.

Although the sales transactions are dismal, prices are remaining relatively stable. The MLS® Home Price Index Composite benchmark was down by 4.6 per cent year-over-year in August 2024. The average selling price was down by a lesser 0.8 per cent compared to August 2023 to $1,074,425. The different annual rates of change between the MLS® HPI Composite and the average selling price were largely due to an increase in the share of detached home sales compared to last year, impacting the average price. On a seasonally adjusted basis, the average selling price edged lower compared to July.

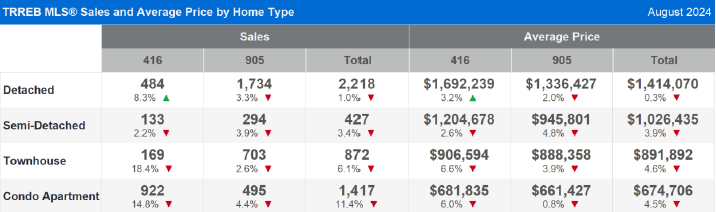

In August, like in June and July, most transactions were in the detached home segment, with 2,218 sales—down just 1% from last year. By contrast, condo apartment sales totaled 1,417, a drop of 11.4%, townhouse sales fell 6.1% to 872, and semi-detached home sales decreased by 3.4% with 427 transactions.

In terms of inventory, the market “remained well-supplied” last month, with 12,547 new listings representing a slight 1.5% rise year-over-year and active listings surged by 46.2 %. Historically, the GTA’s real estate market is known for its lack of supply, but there is now plenty of choice. The last time this happened was during the 2008-09 financial crisis and the early months of the pandemic.

“As borrowing costs trend lower over the next year-and-a-half, home buyers will initially benefit from both lower monthly mortgage payments and lower home prices. Even as demand picks up, especially in 2025, it will take time for the inventory of listings to be absorbed. Ample choice in the market will help keep price growth moderate, at least in the initial phases of recovery,” said TRREB Chief Market Analyst Jason Mercer.

The evolution to a resale market resembling the pre-pandemic resale market will be gradual, but it will begin in the last quarter of this year. It will take time for the inventory of available homes to be absorbed, especially condominium apartments.

The bulk of inventory growth is in the condo apartment sector, with 8,336 units available by the end of August—38% of the total resale inventory in the Toronto region, and nearly 70% of these located in Toronto. Condo sales fell 15% year-over-year in August, with average prices dropping 6% to $681,835. In contrast, sales and prices for detached and semi-detached homes remained strong, supporting the overall market.

TRREB CEO John DiMichele commented on the longer term. “Today’s elevated listing inventory will ultimately recede. We need to maintain a sustained focus on boosting home construction, especially as it relates to producing the right mix of home types to meet consumers’ needs. This new housing also must be affordable. Municipalities can help by reducing development charges, which are ultimately passed on to home buyers. If people can’t find affordable housing in the GTA or surrounding Greater Golden Horseshoe, they will move elsewhere, and not necessarily to other parts of Ontario or Canada. Housing is a key driver of our region’s economic development.”

The Bank of Canada is expected to lower its benchmark rate further in October and December, potentially bringing it down to between 3.50% and 3.75% by year-end. This reduction, along with improved borrowing costs and the absorption of available inventory, will help normalize the Toronto region’s residential resale market. However, this process won’t happen overnight, though the shift is already underway.

Now is an ideal time for buyers to enter the market while it’s still cool. Prices are likely to rise once the market rebounds and competition increases. With interest rates expected to decline, it’s worth locking in a purchase now, even at slightly higher rates—you can always refinance in a year when rates drop further.