While the Toronto real estate market cooled over the summer months as it typically does, the demand for housing ownership in the Greater Toronto Area (GTA) remained strong for August. The Toronto Regional Real Estate Board (TRREB) is reporting the third-best sales result on record for the month of August.

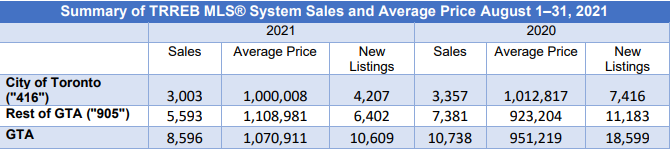

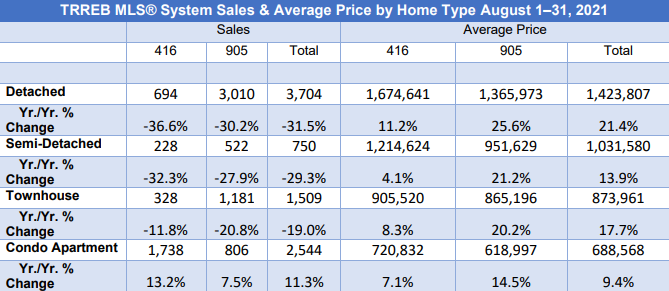

TRREB reported 8,596 properties sold in August 2021, down by 19.9 per cent compared to the August 2020 record of 10,738 and an eight per cent fall from 9,368 in July. We must keep in mind though; sales broke with seasonal tradition last year and were much higher than normal last August. The condo market segment bucked the overall sales trend, with year-over-year growth in sales, continuing a marked resurgence in 2021.

A few things were evident in August, that will most likely continue to impact the Toronto and area residential real estate market for the remainder of this year and most likely into 2022.

The most important is the continuing supply issue. In August only 10,609 new properties were put on the market. This is a sharp contrast to the 18,599 properties listed in August 2020. At the end of August there were only 8,201 properties available to buyers, a 51 per cent decline from the same period last year when 16,662 properties were available for purchase. This is the lowest level of inventory in over a decade. This ongoing supply problem has now become critical resulting in even tighter market conditions with double-digit annual increases in selling prices.

Those wishful buyers looking to enter the market who hoped prices may cool are faced with the grim reality that the average selling price for all home types combined in the GTA was up by 12.6 per cent year-over-year to $1,070,911.

Another trend that continues to emerge is the disparity in prices between the 905 suburban region and the City of Toronto (416). The pandemic and its impact on the changing needs of the house buying consumer has been dramatic. Before the pandemic house prices in areas surrounding the City of Toronto, known as the 905 areas, were lower on average than prices in the city, nor did house prices rise as quickly in the 905 regions. That has all changed during these past 18 months.

In August the average cost of a home in the 905 region hit $1,108,981, up from $923,204 the year before. By comparison, the average price of a City of Toronto home was $1,000,008 in August, down from $1,012,817 the year before. Also, the increase in average sales prices was much greater in the 905 region than in the City of Toronto. In the 905 region detached properties increased in price by 26 per cent, semi-detached by 21 per cent, townhomes by 20 per cent and even condominium apartments increased by almost 15 per cent. While in the City of Toronto detached properties increased by 11 per cent, semi-detached by 4 per cent, townhouses by 8 per cent, and condominium apartments sales prices by 7 per cent.

The reasons for this disparity, there is less housing supply in the City of Toronto, except for condominium apartments, house prices are still higher in the City of Toronto, and the pandemic has brought about the need for space and safety, along with the ability to work remotely, has moved more buyers to the suburbs and more rural markets.

There also seems to be a levelling of prices in the past couple of months. Indeed, August’s average sale price of $1,070,911 for all properties sold in the GTA was a 12.6 per cent increase over the average sale price of $951,219 in August 2020 however it has slightly declined month over month since May’s record-breaking average sale price of $1,108,362. There has not been the frenzy in the market there was earlier in the year, but tight market conditions will prevail into the fall as it is clear the supply of homes is not keeping pace with demand, and this situation will become worse once immigration into Canada resumes.

The resurgence in condominium apartment sales continued in August and it appears the market is back. Condominium apartment sales and prices were hit hard in the early months of the pandemic. Consumers were moving to ground level properties due to the density of condominium living and the fear of the virus. And many were moving to the suburbs and more rural markets as properties were less expensive coupled with more space and the psychological benefit of safety.

August sales confirm the condominium apartment has turned around. In the City of Toronto condominium apartment sales increased by more than 13 per cent with 1,740 apartment units selling year over year. This represents nearly 58 per cent of all properties reported sold in the City of Toronto in August which is quite phenomenal. The average days on market was 21 days for all condominiums sold in August and selling 102 per cent of their asking price. In Toronto’s central districts where the majority of the condo sales occur, the average sale price was $783,712 which is beginning to exceed pre-pandemic price levels. Condo sales are both robust and offer more choices on the supply side. As August came to a close, there were 3,577 condominium apartments listed for sale. This surprisingly is 44 per cent of the total available supply of 8,201of all property types in the GTA.

With the election date now coming close, these numbers make it clear that the only housing item on all parties platforms should be supply and strategies to achieve it.

TRREB President Kevin Crigger didn’t shy away from sharing his thoughts regarding Canada’s current political climate, where housing issues are front and centre on campaign platforms.

The federal parties vying for office in the upcoming federal election have all made housing supply and affordability a focal point. Working with provincial and municipal levels of government on solving supply-related issues is much more important to affordability than interfering with consumer choice during the home buying and selling offer process or revisiting demand-side policies that will at best have a short-term impact on market conditions,” said Crigger.

And TRREB’s CEO John DiMichele is calling for meaningful change. “Bold action, not promises, are needed to ensure that Canada has a stable and sustainable housing market now and, in the decades, to come. This will ensure that the Greater Golden Horseshoe remains competitive on the global stage, in terms of attracting businesses and households to the region,” said DiMichele.

Expect similar results in September as were achieved in August with the continued limited supply of listings and the market will remain in favour of sellers.