The Toronto real estate market is experiencing a spring slowdown, shifting more in favour of buyers after four consecutive months of increased listings. While the rise in inventory has helped stabilize prices, it hasn’t led to more transactions with sales volume down across the Greater Toronto Area (GTA).

According to the latest figures from the Toronto Regional Real Estate Board (TRREB), April showers brought a slump in home sales compared to April 2023, when there was a temporary resurgence in activity after an interest rate-driven cooling following the city’s red-hot pandemic real estate run.

Home sales in the GTA rose by 8.4% from the previous month, totaling 7,114 homes sold in April 2024. Despite this monthly increase, sales have dropped by 5.5% compared to the same period last year. The sales-to-new-listings ratio (SNLR) fell to 42% in April from 50% in March, suggesting that the supply of available homes is growing faster than demand, which slightly favors buyers, yet the market remains balanced.

New listings surged to 16,941 in April 2024, up 49% from April 2023. Active listings at the end of the month reached 18,088, the highest April total since 2018, while sales numbers hit their lowest for April since 2020. This number also represents a 75% increase in the number of properties available last April.

“Listings were up markedly in April in comparison to last year and last month. Many homeowners are anticipating an increase in demand for ownership housing as we move through the spring. While sales are expected to pick up, many would-be home buyers are likely waiting for the Bank of Canada to actually begin cutting its policy rate before purchasing a home,” said TRREB President Jennifer Pearce.

Meanwhile, TRREB’s Home Price Index (HPI) Composite benchmark remained relatively stable at $1,128,100, marking a 1.3% increase from March 2024, though it has decreased by less than 1.0% over the past year.

The average home price in the GTA also saw growth, reaching $1,156,167. This represents a 1.5% rise from March’s average, and a modest 0.3% increase year-over-year.

Additionally, the median home price, often seen as a clearer market indicator, increased to $981,500 in April 2024, up 0.4% from March. However, it shows a 1.8% decline compared to April 2023.

“Generally speaking, buyers are benefitting from ample choice in the GTA resale market in April. As a result, there was little movement in selling prices compared to last year. Looking forward, the expectation is that lower borrowing costs will prompt tighter market conditions in the months to come, which will result in renewed price growth, especially as we move into 2025,” said TRREB Chief Market Analyst Jason Mercer.

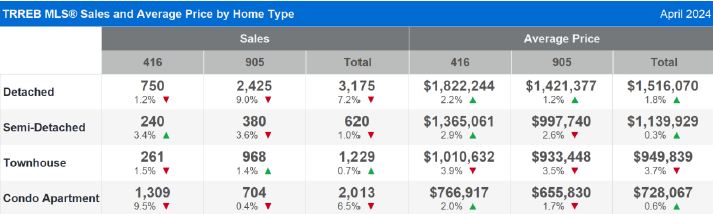

In the City of Toronto, average home prices rose year over year across all but one home type in April. Detached homes, semi-detached homes, and condominium prices increased by 2.2%, 2.9%, and two%, respectively. Townhomes declined 3.9%. The average price for a detached home in the City of Toronto in April was $1,822,244. Notably, all detached properties reported sold in Toronto Central, which includes some of the most expensive neighborhoods, sold in just 18 days at full asking price.

Activity in the semi-detached sector was even stronger. All semi-detached properties in the City of Toronto sold for 108% of the asking price, remarkably within just 12 days.

Condominium apartments, the largest segment of available properties, underperformed in April, dragging down the overall resale market. All condos sold in April took 26 days and fetched 99% of the asking price, with an average sale price of $728,067. Sales were down 9.5% compared to last April. Even more concerning, 5,542 new condo listings came to market in April, accounting for almost 33% of all new inventory. By the end of the month, 7,015 condos were available, making up nearly 40% of the total inventory.

buyers were expected to jump into the spring market before interest rate cuts fearing it would spur skyrocketing home prices.

In summary, there’s a timing mismatch between sellers and buyers. Sellers anticipated a spring market surge with buyers jumping into the market before interest rate cuts, fearing it would spur skyrocketing home prices. However, buyers are waiting for actual rate reductions amid ongoing uncertainty. Although economists predict the Bank of Canada might cut rates by June, there’s no guarantee.

Last spring, Toronto saw a sales surge when the Bank of Canada paused rate hikes, but this year’s less definitive signals have cooled the market. High interest rates are affecting affordability, making homeownership more expensive despite a nearly 15% drop in Toronto’s average home price from its $1.33 million peak in February 2022. The rapid rate increases over the past two years have made it 30% more costly for variable rate mortgage holders.

“All levels of government have announced plans and stated that they are committed to improving affordability and choice for residents. However, more work is needed on alignment to achieve these goals, whether we’re talking about bringing enough housing online to account for future population growth or finding the right balance between government spending and combatting inflation. We can’t have policies in opposition. Housing policy alignment is key to achieving sustained, tangible results,” said TRREB CEO John DiMichele.

Looking ahead, similar market results are anticipated in May. The average sale price will likely remain around $1,150,000, with approximately 7,000 plus home sales. The market remains in a state of limbo while closely watching the Bank of Canada for the much-anticipated rate cut expected in the June or July announcement.