With the spring market in full swing, the recovery in Toronto’s housing market continued to gain momentum in April. The number of homes sold and prices climbed for a third month in a row, and competition among buyers ramped up in the Greater Toronto Area (GTA) as a consistently low number of listings offers would-be buyers with few options.

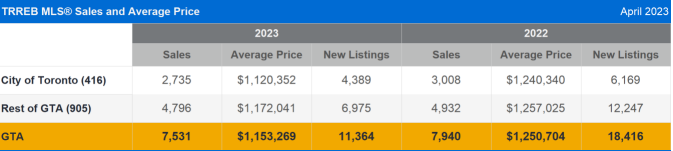

For all of the GTA, the Toronto Regional Real Estate Board (TRREB) reported 7,531 homes sold in April. This marks a rather significant 9.2% jump from March sales and is only a 5.2% drop compared to April of last year.

The number of new listings coming to market continues to be troubling and far from keeping pace with the jump in sales. A total of 11, 363 new listings became available to the many buyers waiting to buy. This marks a 1.6% increase over March and a 38.3% decline compared to the 18,416 properties that came to market last April. At the end of April, there were only 10,373 active listings, more than 20% less than the 13,092 properties available to buyers at the end of April last year.

“As demand for ownership housing has picked up relative to supply, we are seeing renewed upward pressure on home prices. For a short period of time, higher borrowing costs trumped the impact of the constrained housing supply in the GTA. Renewed competition between buyers is once again shining the spotlight on the persistent lack of listings and resulting impact on affordability,” said TRREB Chief Market Analyst Jason Mercer.

Some homeowners have been reticent to put their properties up for sale when prices are still lower than last year. With home prices picking up, Mr. Mercer said we may also see an upward trend in listings: “Listings growth is often correlated with price growth”.

For most of last year, many prospective buyers were uncertain about the pace of interest rate increases and were waiting for home prices to fall further. However, after the Bank of Canada took a pause from hiking interest rates earlier this year, buyer confidence has returned, and many buyers have entered the market again. Demand has also been accelerated by the growth in population in the GTA with high levels of immigration. Between 2018 and 2022, more than 600,000 immigrants have moved into southern Ontario, and new housing supply has not kept pace with the population growth.

As a result of the demand and lack of supply in the GTA, average home prices are on the rise. The average selling price in April across the GTA hit $1,153,269 — a slight increase of 4% from just one month prior and only 7.8% lower than the average sale price achieved in April 2022. The home price index, which excludes the highest-valued properties, rose by 2.4%to $1,145,700 from March to April, according to (TRREB). That marks the second month the index rose over 2%, after a 1% rise in February.

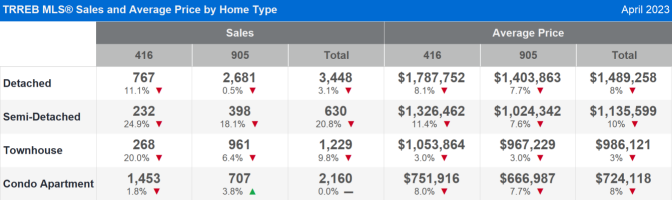

Price increases were seen across all housing types in the GTA, but the biggest change was found in townhomes, where a 5.5% month-over-month increase brought the new average price to $986,121 after an average of 12 days on the market. It was followed by semi-detached homes with a 4.4% increase to $1,135,599 after an average of 11 days on the market, condos with a 2.8% increase to $724,118 after an average of 22 days on the market, and detached homes with a 1.4% increase to $1,489,258 after an average of 15 days on the market.

In the City of Toronto, the new average price of a detached home in April was $1,787,752, semi-detached homes came in at $1,326,462, townhomes at $1,053,864 and condominiums $751,916.

“Lack of affordability in the GTA ownership and rental housing markets has been well-documented. On top of this, households faced with steep price increases for basic goods and services have had to make tough decisions to adapt. It is time for governments to make tough choices as well. On average, every dollar a household makes in the first half of the year goes to taxes. Governments need to provide more value for every tax dollar they collect and should be looking for ways to reduce tax burdens moving forward,” said TRREB CEO John DiMichele.

Rents have also been on the rise over the past year and remained stubbornly high in April. Record immigration with most newcomers renting, high interest rates keeping first-time home buyers on the sidelines, and inflation are all drivers of rising rents, increasing demand, and low vacancy rates. The average rent in Toronto for April was $2,822. This was relatively unchanged from March, however, year-over-year it is an increase of 21.2%.

A similar pattern is anticipated through May with very tight market conditions. Fewer listings relative to sales will bring more competition between buyers, supporting a continued improvement in selling prices. This hopefully will encourage some sellers who have been waiting on the sidelines to list their homes.