The May 2022 real estate statistics released by the Toronto Regional Real Estate Board (TRREB) for the Greater Toronto Area (GTA) brought no surprises and they tell the story of a market in flux. Interest rates have been on the rise since March resulting in a decline in the number of properties sold, and the average sale prices have trended downward from the record-breaking prices in February 2022. In short, after reaching a peak in February 2022, the market continued to cool in May.

During the past 18 months, the GTA real estate market has been on fire. Unprecedented demand led to fierce competition amongst buyers that in turn, resulted in a 27% increase in the price of an average home in Toronto, between February 2021 and February 2022.

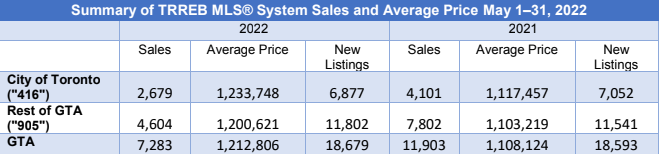

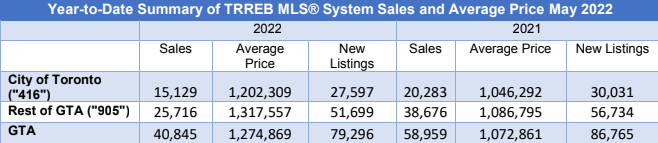

In February 2022, 9,052 homes were sold and the average price of a home (condo or house) in the GTA came in at a jaw-dropping $1,334,544, up almost 28% from February 2021. In May 7,283 properties were reported sold, and the average price declined to $1,212,806. In three months, sales volume has declined by more than 19%, and the average sale price for all properties sold, including condominium apartments, has dropped by 9%.

It is important to keep things in perspective though and not panic. The Toronto market accelerated so fast in the past six months, that a 9% decline in prices only takes us back to October 2021 prices. And it should be noted, that even with this decline, the average sale price in May remains 9.4% higher than that achieved last May at $1,084,124.

TRREB’s Chief Market Analyst Jason Mercer says that today’s conditions remain largely aligned with what the board had anticipated for the year, though market fundamentals have shifted considerably.

“Price trends observed over the past three months — both in terms of moderating annual growth rates and the recent month-over-month dips — are in line with TRREB’s forecast for 2022,” he stated. “After a strong start to the year, the current rate tightening cycle has changed market dynamics, with many potential home buyers putting their purchase on hold. This has led to more balance in the market, providing buyers with more negotiating power.”

There is a notable shift in market dynamics with the change of activity from the suburban 905 region as compared to the City of Toronto. During the pandemic housing boom, suburbs and rural communities experienced proportionately far greater price appreciation than the City of Toronto. With people working from home, everybody wanted bigger homes and more outdoor space and with everything being closed in Toronto, areas outside the city became more appealing. Pre-pandemic, the cost of the average detached house in the 905 region was 68% of the cost of a detached house in Toronto…. however, by February 2022, it had risen to 83%.

This is no longer the case. During the month of May, the average sale price for all properties sold in the suburban 905 region came in at $1,200,621, 2.7% less than the City of Toronto’s average sale of $1,233,748. The ratio of houses sold has also shifted. Last year the suburban 905 region accounted for 66 percent of all properties reported sold, compared to May 2022, only 62% of all properties changing hands were in the 905 region. This is a trend that may continue as people return to their offices and gas prices continue to surge — and the urban exodus we saw during Covid-19 pandemic may begin to reverse.

The average price of a detached home in the City of Toronto rose by 12% year-over-year to hit more than $1.9 million in May, while semi-detached properties increased by about 8% to reach more than $1.4 million. In the 905 region, detached homes increased about 8% year-over-year to more than $1.4 million and semi-detached properties were up by 14% to more than $1 million.

In May 18,679 new properties came to market, which was almost identical to the number that came to market last year. All 7,283 properties that sold in May did so in only 12 days on average, slightly higher than the 11 days it took for properties to sell in May 2021. And interestingly, all properties reported sold, sold for 103% of their list price, 104% in the City of Toronto. At the end of the month, there were 15,433 properties available for sale-nearly four times the record low of 4,140 seen in January. Overall, the market finds itself in better balance

That’s led to an easing of the sales-to-new-listings ratio — the measure of buyer competition in the marketplace — to 65.1%, down from 68% in April. While still indicating sellers’ market conditions, that’s softened considerably from 72.9% at the start of the year. However, conditions remain tight enough to push the overall cost of housing higher, with the MLS Home Price Index benchmark up 23.9% annually.

When assessing the state of the real estate market, months of inventory is a good indicator. This means how long it would theoretically take to sell all the homes currently listed for sale at the current rate of sales. When that number is below four months, it is considered by most to be a Seller’s market, and six months is a balanced market. In May we had 1.2 months of inventory in the City of Toronto which was pretty much the same number as in 2021, very much indicating a seller’s market. However, most likely it is safe to assume we are headed to a more balanced market soon.

The condo market appears to be remaining strong. In May 1,264 condominium apartments were sold in the City of Toronto at an average sale price of almost $800,000-up from $766,462 in May 2021. These condos sold at 103% of their list price and in only 15 days, which is only 2 days longer than it took to sell last year.

At the other end of the market, properties listed at $2 million or more, did not see as severe of a decline in sales as the overall market. Whereas the overall market declined by almost 39%, year-over-year, sales of $2 million-plus properties only declined by a little more than 22%, demonstrating not all sectors of the housing market are responding similarly to the rising interest rates.

May’s market data should not be classified as a market “correction” but rather a market in flux. The economic factors that drove the robust resale market through the pandemic, and even before that, are still present. Primarily the lack of supply and immigration to the GTA and surrounding area. This data shows a market adjusting to the higher rates, and with more to come. Higher mortgage interest rates have a psychological as well as an economic impact on the market, particularly with those buyers that are more rate sensitive and struggling with affordability.

It is anticipated the higher mortgage interest rates will cause average sale prices to decline marginally and plateau during the summer months. The greater Toronto area, and in particular the City of Toronto, has a very high employment rate, and the demand for housing remains strong. Policymakers should not assume that because home sales are off their record peak, we can ignore the lack of inventory in the market. Buyers who have moved to the sidelines will not remain there forever, and the population of our region will continue to grow on the back of immigration. In the absence of new supply, we will build a significant amount of pent-up demand that will need to be satisfied in the not-too-distant future.

“The recent elections have shown that senior levels of government understand the need for more housing to support regional growth. The approval of new and more diverse housing types happens at the municipal level, subject to provincial laws and regulations,” said TRREB CEO John DiMichele. “It will be important to understand the stance of local policymakers as we move toward the fall local elections. The shorter-term impact of higher interest rates will not be with us forever. Supply remains the long-term challenge.”

Unless the Bank of Canada raises the key interest rate and drives the current economy into a recession, then the lack of supply and increasing demand will keep the real estate market strong. When inflation subsides, and the benchmark rate declines, economic conditions, and the housing picture will be very similar to the tight market that existed just before the pandemic hit.